The Finer Things

Shimmering with gold, diamonds and precious stones, these women’s watches represent the pinnacle of haute horology. Just look at them…

Related articles

Bulgari, Van Cleef & Arpels, Chanel, Piaget, Chopard and Cartier were among the prestige brands to unveil women’s novelties at this year’s Watches and Wonders fair in Geneva. Here we review some of our favourites, including a new style from Bulgari who impressed via an artistic collaboration with architect Tadao Ando and Chanel whose latest bobbin cuff was inspired by a spool of thread.

BULGARI

Tadao Ando Serpenti

The brand’s collaboration with lauded Japanese architect Tadao Ando artfully remixes the enduring Serpenti Tubogas model. The collection celebrates the four seasons; pictured here is the Summer (natsu) with a two-tone, yellow-gold-and-steel bracelet and a green aventurine dial. $27,600. Availability on request; Bulgari.com

VAN CLEEF AND ARPELS

Lady Arpels Brise d’Été

The maison’s Poetic Complications novelties ensure that telling the time becomes a spectacle. On this occasion, the flowers on the dial blossom and close in a randomised pattern at the touch of a button. Van Cleef & Arpels’ latest lesson in horological theatre was four years in development, with the dial alone taking 40 hours to master. Price and availability on request; vancleefandarpels.com

CHANEL

Bobbin Cuff Couture

Playing on the vintage “secret” watches of the 1920s, the Bobbin Cuff Couture was inspired aesthetically by a spool of thread. The idiosyncratic jewellery-watch is crafted entirely in 18-karat yellow gold, set with rows of brilliant-cut diamond “threads” and a 17-carat emerald-cut sapphire that hides the watch face. Price and availability on request. Chanel.com

PIAGET

Limelight Gala Precious

At 26 mm, a timepiece that captures the poise and elegance that has come to define Piaget’s jewellery watches. Now, with the inclusion of 38 brilliant-cut diamonds, the 18-karat rose gold “Decor Palace” dial and matching bracelet, this Limelight Gala is arguably the best of a collection that interweaves art, design and jewellery, with an emphasis on beauty. Around $118,500. Availability on request; Piaget.com

CHOPARD

L’Heure Du Diamant Round

Chopard showcases its smarts in the art of diamond setting. Here, the maison’s artisans have orchestrated an amalgamation of contemporary design and alluring precious stones. The green malachite dial is a standout feature, as is the Chopard MD29 hand-wound mechanical movement. Price and availability on request; Chopard.com

CARTIER

La Panthère de Cartier

From one of the brand’s most symbolic collections, this iteration of the Panthère de Cartier watch is designed in a rhodium-finish white gold case set with 136 brilliant-cut diamonds, and a rhodium-finish white gold panther head set with 297 brilliant-cut diamonds. The striking, pear-shaped eyes are crafted from emerald. Price and availability on request; cartier.com

Subscribe to the Newsletter

Recommended for you

Porsche Design Unveils Two Limited-Edition Chronographs to Celebrate 50 Years of the 911 Turbo

The two chronographs incorporate design elements from the iconic 1970s sports car and its modern successor.

August 21, 2024

The 25 Greatest Independent Watchmakers in the World

From F. P. Journe, MB&F, Kari Voutilainen and Greubel Forsey to fresh names on the scene, these are the best small-scale, high-end watchmakers working today.

You may also like.

You may also like.

The 15 Fastest EVs in the World, From Rimac Nevera to the Porsche Taycan

The following battery-powered models all fly off the line at a pace that leaves most gas-fueled counterparts in the rearview.

Internal-combustion-engine apologists love to throw shade at EVs. Dogma and infighting aside, the flow of unbridled electrons offers unrivalled acceleration when compared to gas-burning alternatives. The EV speed advantage is due to the technology’s broad powerband, instant torque, and absence of gear shifts thanks mostly to single-speed transmissions.

While even gas-powered hypercars such as the Bugatti Chiron suffer moments of lag as turbos spool and gears transition, EVs can dispatch power to all four wheels with near instantaneous torque transfer. It’s also worth noting the difference between “quick” and “fast;” the former referring to acceleration while the latter typically relates to top speed, a metric where many gas-powered cars still hold an edge. Semantics aside, here are 15 of the quickest-accelerating EVs in ascending order.

Mercedes-AMG EQE 53 4Matic+

Mercedes-Benz’s top-of-the-line EQS launched the legacy automaker’s entrance into the mainstream EV market, but the smaller EQE outsprints the big-bodied sedan with a claimed zero-to-100 km/h time of 3.2 seconds. The AMG package also bisects the bubble-shaped four-door’s ovoid figure with flares, spoilers, and other visual signifiers that give the 677 hp sedan a more aggressive look than its EQS sibling.

GMC Hummer EV Pickup Truck

The General Motors Hummer EV was conceived with a more-is-more approach to engineering. While many manufacturers seek to optimise efficiency through lightweight construction and slippery aerodynamics, the Hummer EV Pickup Truck tips the scales at over 4,000 kg, a relatively astounding heft that is defied by a touted zero-to-100 km/h time of around 3 seconds. All that mass is overcome by 1,000 hp routed through three motors, offering a maximalist answer to the pickup-truck question nobody asked.

Lotus Evija

While the Evija hypercar from Lotus has yet to reach customer garages, the sold-out flagship is designed with a focus on weight reduction. The $2.3 million two-seater weighs around 1,600 kg, embracing Lotus founder Colin Chapman’s famous maxim to “add lightness.” Lotus also added more than a bit of muscle, with 2,000 hp launching the vehicle from zero to 100 km/h in less than 3.0 seconds. More impressive, the Evija is expected to reach 300 km/h in 9 seconds and have a top speed beyond 200 km/h.

Xiaomi SU7 Ultra

It’s been clear since Xiaomi SU7 was first unveiled earlier this spring that the Chinese electronics giant had its eye on the Porsche Taycan. The company’s debut EV is a sporty sedan with a body that, to put it charitably, looks quite similar to that of the German’s first battery-powered model. But the SU7 isn’t content to just look like the Taycan—specifically the Turbo GT model that circled the Nürburgring Nordschleife in 7:07.55—it wants to move like it too. Enter its high-performance variant, the Ultra, which features a tri-motor powertrain that can produce 1,517 hp. Thanks to all that, the EV will be able to sprint from zero to 100 km/h in 2.8 seconds and hit a top speed of 350 km/h when it eventually goes on sale.

Maserati GranCabrio Folgore

We may still be waiting on the first battery-powered model from Ferrari and Lamborghini, but Maserati has already gone all-electric and the results are impressive to say the least. The marque has a whole line of EVs called Folgore, which includes a coupe (the GranTurismo), a convertible (the GranCabrio), and an SUV (the Grecale). The first two, the GranCabrio is based on the GranTurismo, have a tri-motor powertrain that generates 818 hp, significantly more powerful than the most portent version of their gas-powered counterparts. With all that power under the metaphorical hood, it’s little surprise that the electric GranTurismo can hit 100 km/h in 2.7 second and reach a top speed of 325 km/h.

Nio EP9

The Chinese brand Nio launched its product lineup with the EP9 hypercar in 2016, entering the market with a halo vehicle whose appeal was intended to trickle down to more workaday sedans, SUVs, and wagons. While the EP9’s 1,341 hp, $5.2 million price tag, and rate of acceleration from zero to 100 km/h in 2.6-seconds are all eye-catching figures, the brand’s struggles are perhaps more intriguing.

The company has been pedaling hard to stay afloat, with a $1.4 billion government bailout, ongoing losses, and a still-faltering stock price. Nio’s intention to become the next Tesla was certainly ambitious, but the current challenge is to build affordable cars that produce ludicrous sales figures, not performance numbers.

Audi RS e-tron GT Performance

Like the Porsche Taycan with which it shares a platform, Audi’s RS e-tron GT incorporates a two-speed transmission that helps boost acceleration and improve efficiency at highway speeds. The just-introduced range-topper, the RS e-tron GT Performance, has a dual-motor powertrain that delivers a startling 912 hp, making it the marque’s most powerful production car ever. Thanks to the added power it can leap to 100 km/h in an easy-to-miss 2.5 seconds on its way to an electronically limited top speed of 250 km/h. Though not as uncorked as its sister car from Porsche, this new variant raises the bar for the brand’s sports sedans.

Rivian R1T and R1S Quad-Motor

The most richly funded automotive startup in history might have had a few sales stumbles and hurdles to profitability, but Rivian has had no problem building surprisingly sprightly trucks and SUVs. The upgraded quad-motor powertrain found in the 2025 R1T and R1S delivers 850 hp and 1,500 Nm of torque, the battery-powered pickup can reach 100 km/h from a standstill in 2.5 seconds flat. Also noteworthy is its torque-vectoring capability, which aids its handling and off-road acumen. And the automaker’s recently unveiled R2 and R3 midsize may be even quicker, but we’ll have to wait for verification.

Porsche Taycan Turbo GT

In order to compete with Tesla’s hot-rodded Model S Plaid and the contending Lucid Air Sapphire, Porsche upped the output of its flagship electric sedan’s four motors. Notably, it also took the drastic measure of removing the rear seats, thereby making this Taycan variant a 1,092 hp two-seat four-door.

The track-focused model’s zeo-to-100 km/h time of 2.2 seconds may not be the quickest, but its record-breaking lap times at the Nürburgring Nordschleife and WeatherTech Raceway Laguna Seca racetracks prove the Taycan’s mettle where it matters most to the German brand.

BYD Yangwang U9

BYD has been creating buzz for approaching numbers that threaten Tesla’s global sales crown. The Chinese multinational conglomerate was edged out by Elon’s brand for the first quarter of 2024, but the challenger gained an edge with its curiously named Yangwang U9. Unlike most EV hypercars with four-digit horsepower figures and seven-digit price tags, BYD’s 1,287 hp flagship comes in at $345,000. And that’s for a car that can still scoot to 100 km/h in 2.0 seconds flat. There’s a slight chance it could be even quicker too, since the sports car’s top speed of 375 km/h—high enough to make it the world’s third fastest EV—is actually faster than originally promised.

Tesla Model S Plaid

The Tesla Model S is the car that cleared the way for every other car on this list. More than a decade later, the sedan is still going, even if its dated design has seen better days. Despite its age, the Model S, and especially the high-performance Plaid variant, can more than hold its own. The range-topping four-door has a tri-motor powertrain that produces 1,020 hp and 1,400 Nm of torque, making it even more powerful than the Cybertruck Beast variant. Thanks to all that grunt, the car can shoot from zero to 100 km/h in 1.99 seconds and hit a top speed of 321 km/h (with the right tires).

Lucid Air Sapphire

Lucid’s Air Dream Edition debuted in 2021 with 1,111 hp, disrupting the miniscule EV sedan space with a disarmingly potent offering. The marque’s recently released Sapphire ups the ante when it comes to acceleration, with a claimed zero-to-100 km/h time of 1.89 seconds.

The urgency comes from three motors producing 1,234 hp. That output is routed through all four wheels via a torque-vectoring system that helps the hefty sedan rotate through corners. The EPA estimated range of the five-passenger Sapphire is 687 km.

Pininfarina Battista

If the buttoned-down styling of the Rimac Nevera doesn’t do it for you, you might consider the similarly powerful but more fancifully styled Pininfarina Battista. The Italianate take on the Croatian hypercar claims similarly outrageous numbers—1,900 hp hailing from four electric motors. The zero-emissions power train enables the car to rocket from zero to 100 km/h in 1.86 seconds.

However, key differentiators between the Rimac Nevera and the Pininfarina Battista are the latter’s Luca Borgogno–designed carbon-fibre body—defined by complex curves—and the imaginatively trimmed cabin. The Battista tops out at 350 km/h, though, so it’s not as fast as the Nevera.

Rimac Nevera Time Attack

The Rimac Nevera Time Attack’s 1,813 hp motors can whisk the Croatian-built two-seater to 100 km/h from a standstill in 1.81 seconds. Perhaps more impressive is that it can reach its top speed of 416 km/h and then slow to a stop in a faster total time than it takes a McLaren F1 to reach 350 km/h.

Rimac isn’t betting entirely on electric, however. The brand’s acquisition of the Bugatti nameplate will lead to a hybridised V-16 power plant producing the best of both worlds: the charisma of an old school internal-combustion engine and the efficient speed of battery-assisted torque.

Aspark Owl

The long-delayed Aspark Owl is a Japanese hypercar aiming for a host of all-electric superlatives: the most powerful electric motors (1,980 hp), the quickest EV (zero to 100 km/h in 1.72 seconds), and the fastest as well (418 km/h). Aspark also promises a version bodied in carbon fibre that starts at $5.6 million.

The Owl has been responsible for two Guinness World Records (for eight-mile and quarter-mile average speeds) but shifting production from Italy back to Japan has produced even more delays, requiring patience from would-be owners.

You may also like.

Back in the Race

You can’t replicate provenance. But attitude? That’s another story.

With the effect of seeing a grainy cinematic reel enhanced to high-def, the Cegga 002/60 roars into view, in living colour, on a country road just outside London. The car is a tribute to a Ferrari 250 Testa Rossa that lived a most improbable life: raced, wrecked, then rebuilt and significantly customised, it went on to enjoy notable success on the European racing circuit during the golden age of motorsport—only to be sold and reverted to standard spec some seven years later.

A brief timeline, for clarity: In 1958, on the Freiburg-Schauinsland hill climb in Germany, owner Alfred Hopf lost control of his 250 Testa Rossa and ended up deep in the trees of the Black Forest. The following year, the wreckage was bought by brothers Claude and Georges Gachnang of Aigle, Switzerland, who despite their country’s ban on motorsport at the time, were determined to race. Claude, a gifted mechanic, redesigned the suspension to sharpen the car’s handling, then commissioned Italian coachbuilder Carrozzeria Scaglietti to wrap the tubular steel chassis in a distinct hand-beaten-aluminium body. (The pert tail, for example, owes much to British sports cars of the era.)

The vehicle, christened Cegga 002/60, went on to win numerous European hill climbs in the early 1960s under the banner of Scuderia Cegga—an acronym of Claude et Georges Gachnang Aigle—and appeared on the starting grid at the Four Hours of Pescara and the Nürburgring 1000 km.

But after an accident in 1966, Georges retired from competition and the car was sold to a Ferrari collector who immediately converted it back to stock. Scuderia Cegga and its uniquely styled roadster might have been forgotten entirely if it wasn’t for former English rugby star (and avid historics racer) David Cooke.

In 2016, Cooke, having read about the Gachnangs and their cars, tracked down the brothers, then in their 80s, who shared their trove of technical drawings and period photos of the 002/60. Using a Ferrari 250 GT Boano chassis and a period-correct 3.0-litre Colombo V-12, classics expert Neil Twyman recreated the machine with inboard disc brakes, an ENV differential and independent rear suspension (instead of a beam axle) to match the original Cegga geometry.

The process took four years, with the brothers regularly flying over from Switzerland to provide hands-on advice. In 2019, Cooke raced the Cegga doppelgänger at the Goodwood Revival as a tearful Georges watched, and the replica went on to become a regular sight at historic events.

When in motion, the 002/60 turns more heads than any 21st-century hypercar. Exhaling through twin side pipes, its unsilenced V-12 is brutally loud—any attempt at conversation inside the cockpit is useless—but the modified chassis imbues the drive dynamics with a surprising level of sophistication; with its tactile steering and muscular manual shift, the racer demands, and rewards, every ounce of attention. With the help of UK-based Ferrari restoration house DK Engineering and the Carhuna online auction platform, the Cegga recently sold for nearly US$865,000 (around $1.3m)—a reminder that, with the right build team in your corner, authenticity is sometimes more a matter of attitude than pure provenance. Tim Pitt

Expanding on a motorsport footnote, this meticulous copy of the Cegga 002/60— built on a Ferrari 250 GT Boano chassis— recently fetched nearly US$865,000 at auction.

Studying the Classics

Pretty much all luxury automakers offer track experiences bundled with their latest performance cars, but Ferrari’s Corso Pilota Classiche program instructs owners on how to get the most out of older Prancing Horse breeds. Here are a few tips we picked up around the track. Basem Wasef

• Get Your Mind Right

Classic Ferraris may have looked fast on your childhood poster, but their pace pales in comparison to modern cars. (It sounds obvious, but you’d be surprised by how many people want to hammer their 250 GT like an 812 Superfast.) Vintage exotics require patience when shifting, cornering and stopping; learning to heel-and-toe will improve the car’s rear-end stability under simultaneous braking and downshifting while matching engine revs between gears—and since a little mechanical sympathy goes a long way, the ability to double-clutch is another key skill when dealing with older unsynchronised manual transmissions.

• Love What Makes Your Steed Unique

Vintage machines are engineered with far more variability than mass-produced late-model cars, which means that not only are their driving characteristics quirkier and harder to predict, but two seemingly identical examples can drive differently thanks to manufacturing variances or vagaries in alignment and tuning. And be sure to take the time to understand how to work with your vehicle’s weight distribution: a mid-engined 1989 Ferrari Testarossa, with 60 percent of its weight at the back, will be more apt to spin than a front-engined 1969 Ferrari 365 GTB/4 with 50:50 dispersal. Only by modifying your tactics to work around your car’s distinct characteristics will you learn to bring it to a full gallop.

• Live (and Listen) on the Edge

From slower-revving engines to taller tyre sidewalls, older exotics offer narrower performance envelopes, but ones that are more easily explored than in contemporary supercars. As you approach your vehicle’s limits, you’ll find a world of feedback and communication, from chattering tyres to a dancing steering wheel, and much of the joy of piloting a classic at speed is learning to tune into that symphony of sounds and sensations. Plus, it might save your bacon—as one Corso Pilota Classiche instructor put it, “The only thing that will protect you from your mistakes is your bond with the car.” These machines mostly lack the electronic aids that today’s drivers take for granted—push too hard or ignore what the car is trying to tell you, and you’re flirting with an extremely expensive repair bill (at best).

• Learn How to Stable Properly

Classic exotics aren’t built as robustly as their modern counterparts; from cooling systems to braking capabilities, technology has come a long way since the days of carburetors and crash boxes. Vital fluids, such as those for the clutch and brake as well as the manual-gearbox oil, should be replaced every 15,000 to 25,000 km. When storing an older car for a long stretch, keep the gas tank filled to minimise water build-up but add a stabiliser to prevent fuel breakdown.

• Exercise Frequently

Yes, they’re finicky and relatively fragile, but remember: these machines were built to be driven. Don’t be afraid to take yours out and give the speedometer a twirl. It’s actually the best way to ensure greater reliability in the long run—not to mention the most fun.

You may also like.

Vintage Piaget Watches Have Never Been More Collectible. Here’s What You Need to Know.

Piaget watches are some of the most important and interesting horological accomplishments of the 20th century, yet they remain a bit confounding to collectors.

To get a better sense of how to start going about collecting vintage Piaget watches, Robb Report’s watch and jewellery editor, Paige Reddinger, and I sat down with vintage watch expert James Lamdin of Analog:Shift. Analog:Shift has an impressive Piaget selection on offer, and those are the watches we photographed and include here. We also spoke with watch experts Eric Wind of Wind Vintageand Gai Gohari of Classic Watch Inc., both of whom offered their insights into vintage Piaget.

Piaget and the Small Watch Moment

Last year, just months before Piaget stirred up an enormous buzz by bringing back the Polo 79, I was eating lunch in Manhattan with a savvy, well-regarded watch collector who told me they were, “going after a lot of Piaget at auction.” As this collector began to rattle off this and that Piaget watch as “a milestone in thin watches” or “housing one of the most important movements of the 20th century,” it became clear that vintage Piaget watches were both rich in horological history and undervalued. That’s a killer combo for collectability.

Not long after that lunch, Piaget dropped the Polo 79, Usher started rocking tiny gold Piaget watches at big events, and everyone and their watch-loving cousin seemed to be talking about small dress watches with stone dials, which were often Piagets. Reddinger wrote an article about Piaget having a moment, and Robb Report has also noted the trend toward smaller, dressier watches, especially Cartier, and especially its tiny Tank Mini.

“Piaget as a brand is having a moment, but Piaget as an idea is having a huge moment,” Lamdin told Robb Report. “It’s on everyone’s lips. It’s on every collector’s lips, it’s on every new brand’s lips, it’s on every micro brand’s lips. They’re all talking about the influence that Piaget has as a sort of style icon.”

Eric Wind told us that, “Piaget watches still offer a tremendous value compared to their new counterparts.” And Wind’s colleague Charlie Dunn has written of Piaget that, “…the same dress watches from Cartier, Patek Philippe, and Audemars Piguet command two to three times more at least compared to Piaget.”

Because watch collecting trends are largely driven by the tastes of men, it’s intriguing that these tiny, jewellery-oriented watches are blowing up. Lamdin told us, “I didn’t expect for men to embrace it the way [they have], which has been really interesting. We had this guy come in last week [and] he was . . . like a six-foot-five, six-foot-six kind of guy. He was tall and built, and he had a very petite partner, and they had a bunch of watches out…and there were some big watches, and there were some Piagets. And I made an assumption there: His and hers. I was wrong. He came back two days later and bought the small lapis Piaget for himself. Awesome. I was like, fuck yeah.”

Given our recent take on watches, fashion, and gender, we happily cheer along with Lamdin here. However, why these small watches are having a moment remains a cultural question without obvious or clear answers.

Piaget Are Design-Forward Watches

When we asked Lamdin why Piaget was having a moment, he echoed some of what we proffered in our own take on shifting horological tastes, as well as men embracing traditionally feminine things like grooming and fashion more generally. In our conversation I noted that there’s a feminine moment going on, evidenced by trends such as pendant necklaces and broaches for men, pink clothing, smaller watches, and that this tendency may have helped Piaget become popular.

Lamdin agreed, but then also told us, “For 35 years the entire collector community has been obsessed with tool watches, the idea of a function-forward instrument, which, generally in our world, comes in the form of a 40-millimeter steel diver or chronograph timing device with some sort of historical romanticism behind it, whether it’s diving or flying or space travel or something adjacent. And the thing about horology is it doesn’t have to just be function-forward.”

Lamdin goes on to note that design-forward watches can lean in many niche directions, such as exploring asymmetry and unique materials, even noting that watches don’t need to be functional beyond telling time, which opens up the platform for artistic expression. “I think when you sort of turn the corner on that idea as a collector or as an enthusiast, the world kind of balloons out, and now, all of a sudden, things you never would have considered are captivating,” Lamdin explained.

Reddinger asked Lamdin, “Why do you think suddenly the watch community—which has traditionally been so into movements and tool watches, or had to go long and deep on the escapement on this Patek Philippe—why are they suddenly embracing design?”

Lamdin replied, “We probably do need to mention Covid, right? And Covid was an interesting time for watches in general. And I think people got bored with the same shit because they weren’t just casually reading the blogs on their lunch breaks. They were consuming it for hours and hours and hours every day. And they learned a lot. People got burned out of the same stuff that they were getting fed over and over.” He goes on to note that small dress watches eventually caught fire on social media, and mentions what he called “the Portalnd Oregan effect,” in which “we’re going to try and out-weird one another.”

Gohari told Robb Report, “I think Piaget is having a renaissance right now because we just came out of 10 years of sheep-like vintage watch collecting where everyone wanted the same and most popular steel Rolex or Patek Philippe sports models driving up the prices to absurd like levels. Piaget is the antithesis to that mind set.”

By now, however, Piaget watches aren’t looking quite as weird as they did during the initial wave of revival, which happens naturally as the culture acclimates to the new normal. Piaget is undeniably “in,” so how do we even approach collecting these fascinating little watches?

How to Approach Collecting Piaget Watches

While all this buzz about Piaget watches continues, and prices keep crawling upward (despite the downward trend of the watch market generally), there is a notable dearth of information about vintage Piaget watches. One of the reasons is that, like Vacheron Constantin, Piaget didn’t have a singular hit watch during the 20th century. Brands like Vacheron Constantin and Piaget riffed endlessly on designs, often making just a few of a single iteration and distributing them widely, presumably so that one would not see the same watch where they lived.

Today, the effect of that strategy is that the variety of Piaget watches on offer is somewhat overwhelming. Unlike collecting Rolex or Omega, for example, where one can pick up one of millions of the same mass-produced watch and confidently notch their belt, collecting Piaget requires a keener sense of taste and discretion. The upside is that Piaget collections will pretty much never resemble each other, but the lack of a set formula for building a collection remains a challenge.

We asked Lamdin for advice he’d give to somebody looking to move into Piaget collecting for the first time. Lamdin said, “Probably the same advice I’d give for anything else, which is make sure you’re buying from a trusted source. It’s not uncommon to see refinished dials or replacement dials. It’s not uncommon to get sold a bill of goods on a watch without a functioning mechanism. You know, servicing a [ultra-thin] calibre 9P is not the easiest thing in the world. It’s a very, very small movement. It’s very easy to lose or destroy screws when you’re opening those case backs and the quartz stuff is tricky as well, not always just a battery. You have to rebuild a heat-sink or something, and then you’re in it for three times what you paid for the watch.”

The 9P was the movement around which Piaget first produced its own watches in 1957, seeing off a craze for ultra-thin watches. The 9P was just two mm tall and continues to be regarded by watch collectors with awe.

When we asked Lamdin about certain models that he felt were good to collect, he said, “I personally find myself drawn to anything with the [ultra-thin] 9P [movement], or one of its variants. They made them for ladies. They made them for men. They made them with articulated or woven gold bracelets. They made them on leather straps.”

Gohari, an avid collector of Piaget pointed to some specific references. “Vintage Piaget mostly brings to mind the iconic 18k bracelet Polo model in all its iterations—an unbeatable value for the gold weight and a true pleasure to wear on the wrist—along with the unsurpassed use of stone dials on their dress pieces such as on the classic “Protocole” references (rectangular case on leather strap).”

Gohari goes on to mention the Beta 21 references, which feel “contemporary and so relevant today” as well as the “iconic ‘Andy Warhol’ model offered today in a remixed fashion.”

You may also like.

Hollywood’s French Duel

For rival billionaire moguls Bernard Arnault and François-Henri Pinault, it’s high noon in the battle to stake a claim in the movie business. Is Tinseltown big enough for both of them?

Hollywood is famously awash in irony and blood feuds. So perhaps it’s fitting that, after locking horns for decades in Europe over Gucci, Hedi Slimane and the finest Champagnes, Bernard Arnault and François-Henri Pinault have exported their Gallic rivalry across the Atlantic, each billionaire now determined to conquer the epicentre of film and television just as he has vanquished the world of luxury.

The dueling titans are building foundations in Hollywood that could be transformative not only for their many brands, which are chockablock with unplumbed archives, but also for the entertainment business, which knows how to tell a compelling tale. Last September, Pinault, chairman and chief executive of Kering, bought a majority stake in the CAA talent agency for a reported US$2.8 billion (around $4.3 billion) through his family’s private-investment group, Artémis. Kering, a publicly traded company controlled by Pinault, was not directly involved, but the move raised speculation that its brands—which include Saint Laurent, Alexander McQueen, Gucci, Balenciaga and Boucheron—could benefit from entertainment relationships, particularly among celebrities, who remain the world’s most powerful influencers.

Months later, Arnault, chairman and chief executive of LVMH (also a public company), one-upped Pinault by launching an entirely new entertainment studio in partnership with well-connected Hollywood marketing veterans who, in case the move didn’t sting enough, once worked for CAA. Arnault named the studio 22 Montaigne Entertainment, after his company’s plush address in Paris’s 8th arrondissement, and placed his eldest son, Antoine, in charge.

Fashion designer and musician Pharrell Williams walks the runway during the Louis Vuitton menswear show on Paris’s historic Pont Neuf last June.

Peter White/Getty Images

By the time its formation was announced in February, 22 Montaigne, via its new partners at Superconnector Studios, was reportedly already in talks with potential collaborators, such as Imagine Entertainment, founded by Ron Howard and Brian Grazer, and Reese Witherspoon’s Hello Sunshine. The latter, known for The Morning Show and Big Little Lies, focuses on stories about women, who happen to be LVMH’s primary consumers. Imagine the dramatic, not to mention comedic, tales buried in the vaults of a company that owns Louis

Vuitton, Christian Dior, Givenchy, Tiffany & Co. and Dom Pérignon, among dozens of other top names. The possibilities for brand-centric film, television, streaming and podcast projects that can bring their archives to life are practically endless.

What we’re seeing in real time is a collapsing of the traditional walls between entertainment and luxury—or, more bluntly, a disintegration of the space between storytelling and advertising. Fashion houses have long made nimble use of respected contemporary artists, enlisting them for merchandise collaborations in order to inject a dose of highbrow imprimatur into their wares. More recently, this fluidity has infiltrated the music industry: Pharrell Williams, the massively successful recording artist and producer, is not a trained fashion designer but last year was named creative director of Louis Vuitton menswear, where he’s churning out vibe-y videos, shutting down Paris streets with fashion shows, and racking up social-media engagement. Fashion is now aiming squarely for your screens.

Adrienne Surprenant/Bloomberg/Getty Images

“The sectors of film and art and fashion have become so intertwined today that there’s no separation,” says Robert Burke, chairman of the consulting firm Robert Burke Associates, who counts several luxury giants among his clients.

In front of the camera, fashion and film have been cosy for decades, trading on celebrities’ fame for advertising campaigns and costuming deals.

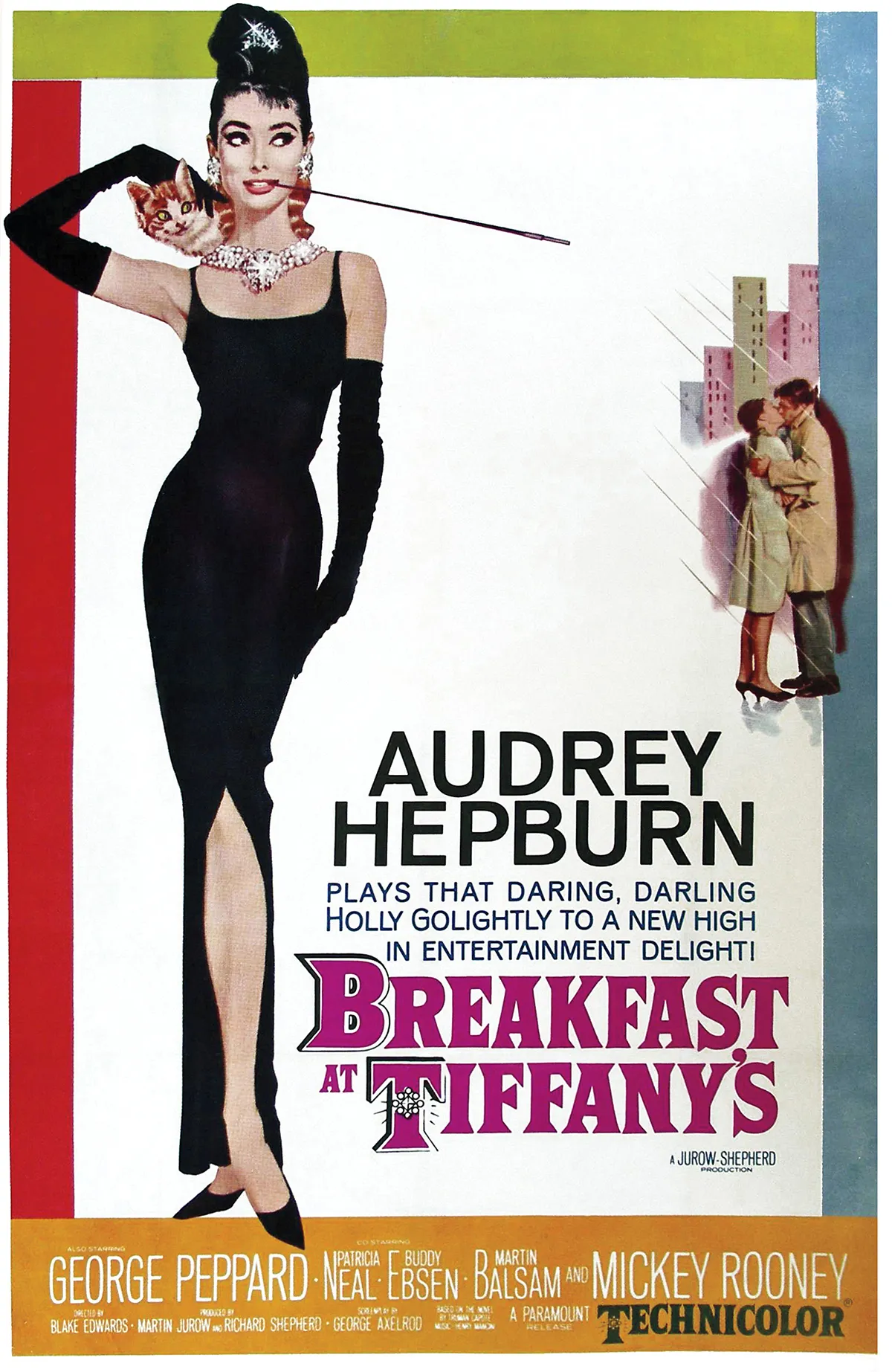

Designers have always nurtured close liaisons with stars—think of the symbiotic relationship between Hubert de Givenchy and Audrey Hepburn, or the way Giorgio Armani burst into our collective consciousness (and wardrobes) by outfitting Richard Gere in American Gigolo. The occasional lucky release has also proved beneficial: the film adaptation of The Devil Wears Prada, the plot of which had next to nothing to do with the Italian maison, elevated it to household-name status in the 2000s, and a certain jeweller has been dining out on Breakfast at Tiffany’s for over six decades. “Still today, that movie and the image of Audrey Hepburn drive tremendous traffic to the Tiffany store,” Burke says.

Fashion-centric documentaries, from 1995’s Unzipped to Dior and I in 2014, have proved surprisingly appealing, and competition shows à la Project Runway oddly enduring. Now, top houses are recognising film and TV as more than publicity platforms: They see them as a means to expand the mass appetite for high fashion through entertainment, not just via fragrances and wallets.

One of the curiosities about Pinault’s and Arnault’s forays into Hollywood is how secretive they’ve both been about something so very public. (Both declined to comment for this article or to make any executive available for an on-the-record interview.) In fact, while it’s usually buyers who make announcements of this nature, a press release on the sale of the CAA stake was issued by the seller, TPG, which clearly wanted to trumpet the deal to its investors. Pinault was quoted in TPG’s release, noting that CAA would add “increased diversity, both in terms of geographical footprint and business activities” to Artémis’s $43 billion (around $66 billion) in assets. He has nevertheless declined every interview request. His longtime spokesman at Kering says that CAA is a private family-investment matter.

Week in February. Jacopo Raul/Getty Images.

LVMH made its own announcement about 22 Montaigne’s launch, sending out a three-page press release from Paris and serving up a few interviews in the business media with its North American chief executive, Anish Melwani, who will manage the operations of the studio along with Antoine Arnault, head of LVMH image and environment. Melwani’s interviews appear to have been seen within the company as a rare misstep. When the news made global headlines—from the Financial Times to Fortune to Fast Company—LVMH and its partners at Superconnector Studios retreated, halting all interviews. “It took them by surprise that this got the amount of attention it got,” a person close to LVMH tells Robb Report, calling the coverage “overblown”.

Arnault and Pinault are not pioneering the alignment between Hollywood and consumer brands. Nike’s Waffle Iron Entertainment, launched in 2021, already has a first-look deal with Apple TV+ and produced The Day Sports Stood Still for HBO, as well as Apple TV’s Ja Morant docuseries Promiseland, merging sports-oriented content with Nike’s athletic products. In fact, one of 22 Montaigne’s partners at Superconnector, a Hollywood marketer named Jae Goodman, helped create Waffle Iron Entertainment. And last year, Authentic Brands, which owns the intellectual property for dozens of marques, from Barneys New York to Elvis Presley to David Beckham, launched Authentic Studios to build films, television shows and other entertainment around its brands.

CAA headquarters in L.A.

CAA headquarters in L.A.

AaronP/Bauer-Griffin/GC Images

The approaches taken by the two Frenchmen—the mirthful François-Henri Pinault, known by friends as FHP, and the meticulous Bernard Arnault, affectionately called Monsieur Arnault—reflect how they run their respective corporate empires. In some ways they’re mirror images, each building businesses from luxury goods and related playthings of the rich and famous. Their private family offices even neighbour each other across a quiet plaza in Paris not far from the Grand Palais, with Arnault’s Financière Agache located at 11 rue François Premier, and Financière Pinault just down the rue at number 12.

LVMH dwarfs Kering by many measures. Its 75 brands are deep with heritage, often centuries old, and generated revenues of over $93 billion (around $143 billion) in 2023, while Kering’s dozen or so are younger and produced over $21 billion (around $32 billion) in revenues last year. The conglomerates have been fierce rivals for decades, competing with each other not only for retail sales but also for companies and talent. Their struggle for control of Gucci in the late 1990s, when Tom Ford was arguably the most influential designer on the scene (and Pinault’s father, François, faced off against Arnault), was epic, and top names have often bounced between the two camps, most notably Hedi Slimane, who jumped from LVMH (Dior Homme) to Kering (YSL) and back (Celine). Taking notes, screenwriters?

Martin Bureau/AFP/Getty Images

While Arnault is an efficient planner who keeps things centrally organised—opening a Hollywood studio to serve all of LVMH fits his profile perfectly—Pinault can be more capricious and prefers to leave details up to brands and their managers. Arnault’s Hollywood manoeuvring appears coolly calculated, while Pinault’s multibillion-dollar investment for 56 percent of CAA has proved something of a head-scratcher to observers from both industries. “If you would have asked me who would come along to acquire CAA, it certainly wouldn’t have been a company that was rooted in fashion and luxury,” says Keith Baptista, cofounder of Prodject, which forged early connections between fashion and entertainment with shows such as Rihanna’s Savage x Fenty special on Prime Video.

Still, in an age when celebrities are the most valuable influencers (think Anya Taylor-Joy’s gushy Instagram post thanking Dior, Tiffany and Jaeger-LeCoultre for her Oscars ensemble in March, which has garnered 2.8 million likes from her 10.6 million followers as of press time, or Taylor Swift’s 284 million Instagram followers, which make her a one-woman media empire) and when creative direction is more about cultural access than apparel design, Pinault now has one of the most potent contact lists on the planet.

CAA represents thousands of actors, directors, models, musical artists, athletes, coaches and other stars. Its agents are some of the world’s most adroit dealmakers. The firm, whose stone-and-glass headquarters looms over Century City, California, boasts that it pioneered talent agencies’ incursions into the sports business, investment banking, venture funds and brand-marketing services, not to mention developing a business arm in China, which is every luxury executive’s fervent dream market.

Emmanuel Dunand/AFP/Getty Images

Hollywood observers suggest the real winners of the deal are the co-chairmen of CAA—Bryan Lourd, Richard Lovett, and Kevin Huvane—who have an opportunity to unload part of their own stakes for as much as $200 million (around $310 million), according to a Financial Times report last September. Then there’s former majority owner TPG, the financial-services firm that sold its shares to Artémis. TPG, which first bought a piece of CAA in 2010, had been looking to cash out of the long-held investment and realise its gains without having to invest more in the agency’s future growth. Few clear options emerged until Pinault happened along.

“Do I think it’s good for Richard, Kevin and the management team? Yes,” says an executive at a rival agency, who suggests that CAA is a trophy acquisition for the Pinaults. In addition to the family’s stake in Kering, CAA will sit alongside a billionaire’s playground of other assets: Christie’s auction house, Artémis Domaines estates, French soccer team Stade Rennais FC, several media and tech investments that include a stake in TikTok-owner ByteDance, and a substantial private art collection.

This executive questions, however, whether the family is prepared to invest the additional money required to expand CAA as its rivals, including United Talent Agency and William Morris Endeavor, push into new fields, and as revenue streams morph. “Do I think it’s good for CAA in the long run? No.”

Barry King/Alamy

But from CAA’s perspective, according to an insider there, Pinault represents a smart, hands-off owner much like TPG was, and not just a private-equity investor with a short-term outlook. It’s expected that board seats will be taken by either Pinault or his Artémis deputy chief executives, Héloïse Temple-Boyer, who sits on Kering’s board, and Alban Gréget.

“We’re not part of his company. We’re just another investment,” this insider says of Pinault. “He knows what he knows. He knows what he doesn’t know. He lets people manage. TPG was the same way.”

But CAA also apparently believes that Pinault has something to offer the agency other than cash. “He has a familiarity in businesses driven by talent. That’s something that he has that normal private equity doesn’t,” the insider says. “We’re just at the beginning stages of figuring out what those opportunities are.”

Adding to the trophy speculation is the presence of Pinault’s wife, the 57-year-old Oscar-nominated actress Salma Hayek, the mother of his youngest child. (Another of his four children is just a year older and is the son of supermodel Linda Evangelista.) Pinault, who is 61, is often photographed standing behind Hayek, unidentified by paparazzi but holding her coat and bag while she signs autographs.

Hayek is represented by CAA, which now answers to her husband. A person who has worked under Pinault for years notes that the actress is close with several of CAA’s principals. “If you want my opinion,” they say, “I think the whole thing is kind of strange. I think it’s Salma-inspired.”

Several Hollywood executives, none of whom would speak on the record, challenged initial speculation that Pinault’s control of CAA will help Kering recruit talent to wear or advertise its labels. Proposing such alliances might instead raise suspicions that they are more for the benefit of Kering and CAA corporately.

“You can’t just jam people in. The agents are going to ask for the richest deal,” says another agency rival, who cites the fiduciary responsibility that agents have for their clients’ best interests. What’s more, the rival adds, “The people who run fashion houses don’t give a shit about the corporate synergies. You can’t tell them they have to use Tom Cruise.”

Like LVMH, Kering is also backing at least one filmmaking venture in support of its brands’ entertainment ambitions. Saint Laurent made a splash at Cannes last year, not just on the red car- pet but also by producing a short cowboy movie by acclaimed Spanish director Pedro Almodóvar, starring Ethan Hawke and Pedro Pascal, called Strange Way of Life.

The title is the first from Saint Laurent Productions, a film-production company the label launched last year, led by its creative director, Anthony Vaccarello. The designer has more projects in the works by Oscar-winning director Paolo Sorrentino and heavyweights David Cronenberg, Abel Ferrara, Wong Kar-wai, Jim Jarmusch and Gaspar Noé.

Vaccarello designed the costumes for Strange Way of Life, so it’s a safe bet that he’ll do the same for future films. People close to the label say the venture began because Vaccarello, a film lover, pressed for the new creative outlet. (He’s not the first designer to catch the movie bug: Tom Ford directed two acclaimed—and, naturally, stylish—features before selling his eponymous brand to Estée Lauder last year; he now focuses full-time on moviemaking.) At the Saint Laurent Productions launch in April 2023, Vaccarello told Variety that filmmaking gives him “the opportunity to expand the vision I have for Saint Laurent through a medium that has more permanence than clothes”.

“You can still see a film in 10 or 30 years, if it’s good,” the designer said. “In some ways, making a film can be more impactful than a seasonal collection. For me it’s a natural extension to another field of creativity that perhaps is more general and popular.”

One more thing promises to be new and fascinatingly strange about these luxury conglomerates’ invasion of the Hollywood jungle: their investments will certainly make odd bedfellows, albeit indirectly, of Pinault and Arnault.

Alamy

There is every likelihood that Arnault’s 22 Montaigne will soon be dealmaking with Pinault’s CAA to lock in directors, writers and stars. Scarlett Johansson is both a CAA client and a Louis Vuitton brand ambassador. Natalie Portman, also repped by CAA, is a leading face for Arnault’s pet label, Dior, which is the first luxury house he bought when building LVMH.

Such crossovers aren’t unusual in Hollywood, where individuals are accustomed to working for rival studios or networks. Unheard of, though, is Arnault’s paying Pinault, via CAA, for the privilege—and here’s our elevator pitch—of signing Ryan Gosling to a Netflix drama, directed by Steven Spielberg, that tells the story of a 17th-century Benedictine monk who perfected the making of Champagne. Dom Pérignon: the Movie, coming soon?

Illustration by SAM GREEN

You may also like.

How to Style Your Loose-Fit Garments This Spring

A sprawling estate in the South of France provides the backdrop for the season’s loose fits and chic separates.

There’s very little innovation without simplification—after all, no one wins friends or influences people by making things harder. So it’s no surprise that spring’s best new clothing feels lighter, looser, fresher—and a lot easier to wear than all the layers you may have donned over the winter.

To celebrate that happy fact, we traveled to Provence—the region that perfected the beautiful life—to capture the season’s finest wares in an environment that reflects their carefree aura. And whether you spend this spring swaddled in Alanui’s enviable knitwear or suited up in Brunello Cucinelli, you should be able to do what the models in the next several images are doing: Relax.

All Photographed by Zeb Daemen Styled by Alex Badia

On him: Tod’s cotton jacket, $4,230; Corneliani cotton knit shirt, $1,285; Officine Générale cotton pants, $550. On her: Hermès linen overcoat with leather collar, $10,135; Chloé wool turtleneck sweater, $1,345.

On him: Dries Van Noten brown linen, viscose and silk coat, $3,610; Ralph Lauren Purple Label white cotton and silk henley shirt, $600; Giorgio Armani cognac linen pants, $3,170, and brown leather belt, $640; Hermès black sandals with notched sole in liquorice cotton serge and calfskin, $1,390. On her: Dries Van Noten camel cotton coat, $2,555; Hermès red knitted cropped top, $2,725, bandeau, $2,725, and skirt (worn as a dress), $3,515; Hunter olive-leaf boots, $280; Tiffany & Co. Lock necklace in 18-karat yellow gold, $6,355.

Brunello Cucinelli wool and linen denim-effect-twill one-and-a-half-breasted suit, $9,220, and denim shirt, $1,740; Tod’s leather loafers, $1,580; Rolex Datejust, stylist’s own.

Alanui cashmere and cotton cardigan, $3,835; Loro Piana linen shirt, $1,360; Kiton silk and linen pants, $13,070 (for full suit); Hermès silk scarf, $325; Giubert leather belt, $425.

On him: Boglioli wool blazer, $2,495; Officine Générale cotton shirt, $490; Berluti cotton pants, $1,240; Hermès silk Twilly scarf, $325; Ralph Lauren Purple Label canvas espadrilles, $750.

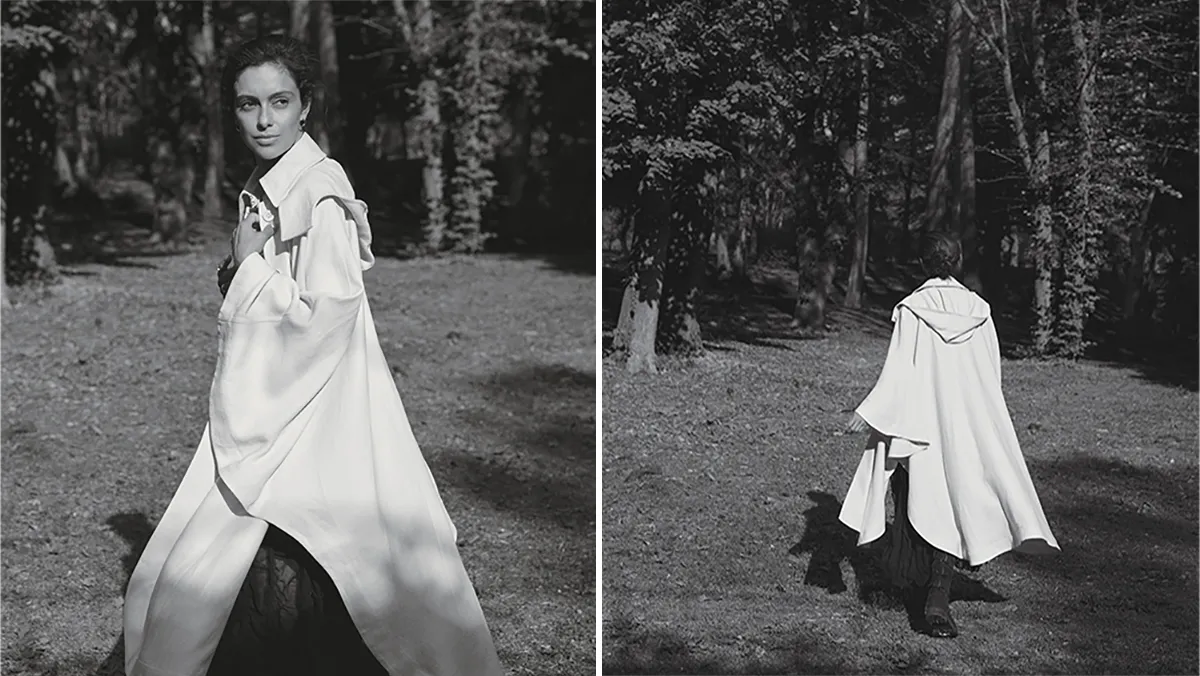

Chloé coconut-milk linen-crepe sable hooded cape (price upon request); Dior black silk skirt with ruffles (price upon request) and fringed canvas boots (price upon request); Piaget Possession open hoop earrings in 18-karat rose gold and diamonds, $7,490, open ring in 18-karat rose gold and diamonds, $7,565, and Decor Palace ring in 18-karat rose gold and diamonds, $6,280.

On him: Tod’s cotton jacket, $4,230; Corneliani cotton knit shirt, $1,285; Officine Générale cotton pants, $550. On her: Hermès linen overcoat with leather collar, $10,135, and leather boots, $3,985; Chloé wool turtleneck sweater, $1,345.

On her: Loewe wool sweater, $4,160, and suede trousers (price upon request); Dries Van Noten shoes (price upon request).

On him: Loro Piana baby cashmere cardigan, $7,185, sweater, $4,765, and wool, linen and cashmere pants, $2,120; Giorgio Armani belt, $645.

Photographed at Chateau d’Estoublon.

Casting and Market Editor, Men’s: Luis Campuzano Market Editor, Women’s: Emily Mercer

Models: David Miller and Gabriela Salvadó

Senior Fashion Market Editor, Accessories: Thomas Waller Watch and Jewellery Editor: Paige Reddinger

Fashion Assistant: Annelise Lombart-Platet

Makeup Artist: Vera Dierckx using Less Is More Organics Cosmetics Hairstylist: Eduardo Bravo

Photo Director: Irene Opezzo Photo Assistant: Koen Vernimmen Production: yours,