The 25 Most Expensive Homes In The World For Sale

From Hong Kong to the Hamptons, here are the priciest listings on the planet.

Last year wasn’t exactly the best on record for the prime real estate marketplace, but even as a certain global pandemic extends further into its second year, things seem to be slowly bouncing back. Manhattan and other big cities made a rebound in 2021 as people slowly returned to in-office work, resulting in one of the Big Apple’s best years in terms of luxury sales in well over a decade. Some pandemic trends still persisted, though, like the slew of private islands that returned to market, aiming to capitalize on buyers’ desire to have a paradisal escape in their back pocket in case of future global crises.

One of the biggest changes to look out for next year is the return of buying internationally. As travel becomes more and more commonplace, you can expect to sales of more multi-million-dollar listings in major metropolises. As for 2021, there’s still plenty of incredible homes to choose from. Below, our list of the 25 most expensive homes currently on the market around the world.

25. Pumpkin Key, Florida Keys, Florida — $131 Million

Courtesy of Sotheby’s International

Pumpkin Key has been a regular on this list as it’s been taken on and off the market over the years. That being said, there’s no better time to buy a private island than now, when we all wish that we’d had one last year. Located in the Florida Keys, this particular isle isn’t too far from Miami (it’s about 10 minutes by helicopter) and already has a three-bedroom main home built on it. Also included are tennis courts, two caretaker’s cottages and a series of golf cart paths. For those who’d like to explore the surrounding waters, the on-site marina is large enough to accommodate a megayacht. You’ll likely want to add a few more structures to the 26-acre parcel though, so best start planning now if you’re interested.

24. Willow Creek Estancia, San Diego, California — $135 Million

Brent Haywood Photography

Willow Creek Estancia will appeal to many different lifestyles, but it has the most perks for equestrians, who will be drawn to its 27-stall main barn, additional eight-stall barn and sand arenas. Altogether it’s a 77-acre parcel and includes a 15-acre lake filled with bass. Also included with purchase is a bevy of sportier amenities such as a tennis court, a lap pool and a two-lane bowling alley. The main home is 1393sqm and comes with six bedrooms and seven bathrooms, if you’d rather just kick back and relax inside.

23. Stonewall Farm, Westchester County, New York — $138 Million

Christie’s International Real Estate

Stonewall Farm, which was featured on our list last year, still hasn’t found a buyer willing to shell out $138 million. The epic, 740-acre equestrian estate is Westchester County’s largest, and has produced the winning horses of 40 stakes races. The owner, Calvin Klein cofounder Barry Schwartz, developed the property for about 40 years to create room for 88 steeds. Just an hour from Belmont Park, the grounds also sport a turf race track, round pens and fenced paddocks. Not to be outdone, the 2230sqm Colonial manor house, which was designed by New York-based architect Rebecca Rasmussen, offers eight bedrooms, eight bathrooms and one of the most impressive libraries we’ve seen. There’s also a 18-metre, gardens and a butterfly house in case you get sick of the horses.

22. Padaro Lane, Santa Barbara, California — $138 Million

Blake Bronstad Photography//Douglas Elliman

Padaro Lane’s biggest perk is its private beach. Situated in the oceanside town of Carpinteria, which is part of Santa Barbara County, it’s a location that already feels relatively quiet and secluded. The existing 232sqm home here isn’t the grandest ever, so it’s really the land and location that you’re paying for. The residence sits on 4.2 acres, and the property is zoned to stable up to nine horses, which is great for the equestrian who wants to start building stables right away. Of course, you can just lounge by your own personal beach instead—that’s the more relaxing option anyway.

21. Little Pipe Cay, Exumas, Bahamas — $138 Million

Photo: Lifestyle Production Group

The Covid-19 pandemic has generated significant interest in private islands as of late. That momentum sparked Little Pipe Cay to relist, this time for $20 million more than it originally asked in 2018. The big draw here is that, unlike many other isles on the market, this one already has all of the necessary infrastructure in place, so you can move in right away. It’s a 40-acre piece of land altogether, with a 492sqm main residence that comes fully furnished. Since it’s situated in the Exumas archipelago it’s not too far off from Miami either, should you want to return to the city for a spell. However, like any private island, operational costs are a factor here—you’ll have to cough up about $2 million per year to keep it up and running. Build it out into a resort, though, and the place may just pay for itself.

20. The Atherton Estate, Atherton, California — $138 Million

Photo: Bernard Andre

Atherton, California, consistently ranks No. 1 on Property Shark’s annual Most Expensive US Zip Codes list, so it makes sense that it appears on our tally of the world’s priciest homes. The $138 million listing was for many years the summer home of Doris and Donald Fisher, the founders of clothing retailer the Gap, Inc. Over the years additional parcels have been added to the main property, so it’s eight acres of land altogether—a rarity for the area. There are two homes on the property, plus a pool, pool house and tennis court, but the beauty of having this much space is that you can develop it into whatever you want. Add an oversized garage if you’re a car collector or build another guest house for visitors. Your call.

19. Villa Theoule Sur Mer, Cannes, France — $140 Million

Côte d’Azur Sotheby’s International Realty

Another year and Villa Theoule Sur Mer still hasn’t found a buyer willing to dive in. The Cannes estate, which is characterised by a jaw-dropping 50-metre infinity pool, now wears a price tag of about $140 million. Instead of a single sprawling mansion, there are four houses at about 278sqm surrounding the pool, along with two 74sqm apartments. Each abode carries its own theme—water and light, for example—which is reflected in the design and furnishings. On top of that, the lush grounds offer 240-degree views of the coast, as well as a separate spa area and pool house. Let’s be honest, though, it’s really all about that pool.

18. El Rancho Tajiguas, Santa Barbara, California — $152 Million

Courtesy Matthew Momberger

There’s nothing better than a twofer, especially in the world of luxury real estate. Enter El Rancho Tajiguas. The $152 million ranch, which comprises 3,500 acres on Santa Barbara’s Gaviota Coast, comes with not one but two homes. Villa Della Costa and Villa Del Mare both span more than 10,000 square feet and collectively offer 10 beds, 22 baths, two pools, wine cellars, bars and theatres. The real draw is the acreage, though, which features avocado groves, persimmon orchards and plenty of cattle ranges. With barns, crop storage areas and water storage reservoirs, you’ll have all you need to support about 200 animals, plus a visitor or two.

17. Steve Wynn Mansion, Los Angeles, California — $158 Million

Courtesy of Hilton & Hyland

Casino mogul Steve Wynn relisted his Beverly Hills digs this year at a price cut—it was originally put on the market for $186 million in 2020. Nevertheless, the property is a significant piece of real estate, with a 2500sqm home and 2.7 acres of land. Wynn’s shopping it for significantly more than he originally paid: a mere $65 million in 2015. Like the former executive’s glitzy Las Vegas properties, the residence feels a bit like a resort, complete with a tennis court, swimming pool and pool house. It’s not the only home that he’s shopping at the moment either: Wynn also relisted his Vegas pad this year for $33.8 million. Care to roll the dice and make him an offer?

16. Green Gables, Woodside, California — $186 Million

Photo: Courtesy of Christie’s International Real Estate.

Sometimes it pays to keep it in the family. Take Green Gables, for instance. The storied home, which was originally built by banker Mortimer Fleishhacker back in 1911, has been passed down in the family for generations, and is now priced at a hefty $186 million. Located on 74 acres of land in Woodside, the estate comprises a main home designed by architects Charles Sumner Greene and Henry Mather Greene, along with six other dwellings. Altogether the place has 32 bedrooms, plenty of spots for entertaining and even a Michelin-star pub. The grounds are the real star here, though. The acreage includes several bike and hiking trails, along with picturesque lakes and gardens, plus a tennis court and an outdoor pool.

15. The 79th Floor at 432 Park Ave, Manhattan, New York — $186 Million

Photo: Devon Banks

It’s been an eventful year for 432 Park Ave. The supertall has always garnered criticism for its design—architect Rafael Viñoly was inspired by a metal garbage can, after all—but this time, the ire came from within the building itself. In a February New York Times report, residents spoke out about structural issues that made the 425-metre tower feel less-than-luxurious; complaints included flooding, stuck elevators and noise. In September, the condo board sued the developers over these problems.

It should come as no surprise, then, that some owners are calling it quits. One example is on the 79th floor, where a unit listed this year for a whopping $186 million. Unlike other overpriced apartments in this building (see No. 11 on this list), there’s some case to be made for the asking of this full-floor offering. It’s designed by Japanese artist Hiroshi Sugimoto, and represents his first interiors project in New York City. The photographer sourced many of the materials used for the wabi-sabi style home from Japan, such as ancient cedar planks from Yakushima Island and stone tiles from Kyoto tram stations. What’s most notable is the permanent art installation that comes with the 748sqm residence. Dubbed Ukitsobo, or Floating Inner Garden, it’s comprised of two bonsai trees standing opposite one another.

14. Le Palais Venitien, Cannes, France — $186 Million

Côte d’Azur Sotheby’s International Realty

When a property is called “the Palace,” you know it’s going to be royally good. That’s certainly the case with Le Palais in Cannes. Located on nearly six acres that overlook the Mediterranean, the palatial, 2972sqm mansion was inspired by the city of Venice and its historic architecture; think monumental columns, stately arches and fountains aplenty. Inside, the manse offers nine suites, 12 bathrooms, numerous reception rooms and an impressive wine cellar. You can also expect lavish furnishings characteristic of Venetian design. Outside, meanwhile, there’s an expansive pool, tennis court and a secluded woodland with its own lake. Who needs the Grand Canal?

13. Vatuvara Private Islands, Fiji — $214 Million

Vatuvara Private Islands

A mansion is great, but your own resort is better. Priced at $214 million, the Vatuvara Isles comes with a set of luxury hotel villas, along with a private Twin Otter aircraft to get you to and from the far-flung Fijian island. You can choose to continue running the three villas as is, or relinquish managerial duties and turn them into an exclusive oasis for yourself. In addition to this main island, the purchase also includes three other isles that are much less developed. That means there is scope to create more seaside escapes for you and your crew. It’s social distancing at its finest.

12. The Sanctuary, Santa Barbara, California — $221 Million

Jim Bartsch

The Sanctuary at Loon Point certainly lives up to its moniker. Priced at $221 million, the crown jewel of the West Coast combines the natural beauty of California with exclusive luxury living. Roughly seven miles south of Santa Barbara, the 22-acre oceanfront estate includes five individual land parcels that are connected by a private, gated road. The brainchild of hedge funder and philanthropist Bruce Kovner, the Sanctuary currently offers two mansions that span 743sqm each, but the future owner can also opt to build additional homes. Not that you will need to, of course—right now there’s a total of 10 bedrooms and 21 bathrooms on the property, along with a spa, pool and adjoining cabana. You even have your very own citrus grove.

11. The Penthouse at 432 Park Ave, Manhattan, New York — $233 Million

Photo: Donna Dotan

Sure, living on the uppermost floor of a nearly 425-metre tower is great, but $169 million is asking a lot. The price is almost double what the owner, real-estate developer Fawaz Alhokair, paid for it in 2016. On top of that, 432 Park Ave has had plenty of negative buzz this year (for more on that, see No. 15 on this list). Still, it’s not without its perks: The penthouse is a full-floor unit with 24 windows, so the home certainly takes advantage of its lofty location. All of the furniture is part of the deal, too, including pieces from Hermès, Fendi and Bentley, plus a custom piano that has a brass plate printed with “Penthouse 96” on the side. What’s it like to live here? Alhokair wouldn’t know, as he never actually moved in. You’ll have to see for yourself.

10. Mylestone at Meadow Lane, Southampton, New York — $241 Million

Photo: Courtesy of Bespoke Luxury Marketing

It’s hard to pick a highlight of the Hamptons, but this waterfront estate could be it. Priced at $241 million, Mylestone at Meadow Lane offers more than 152-metres of ocean frontage, between the Atlantic Ocean and Shinnecock Bay, along with eight lush acres. The modern Tudor-style mansion, which spans a little over 1393sqm, comprises 11 bedrooms, 12 full baths and four half baths, as well as a separate caretaker’s cottage. You can expect custom millwork and water views throughout, along with all the modern amenities. Outside, there’s ample room for entertaining, plus a pool, hot tub, five-car garage and a deepwater bayside dock for boating.

9. Mesa Vista Ranch, Pampa, Texas — $276 Million

Courtesy of Hall and Hall

Mesa Vista Ranch has been on the market since 2017, but it hasn’t managed to attract one lone ranger, even with a few price cuts. That’s not to say it’s by any means unappealing. Now asking $276 million, the sprawling estate consists of a whopping 65,000 acres in the Eastern Texas Panhandle. The handiwork of the late financier T. Boone Pickens, who spent about half a century developing the property, the ranch comes complete with a giant 3065sqm main residence and its very own two-story pub. Fit for nature lovers, the acreage has been equipped with manmade streams and a set of new conservation practices to preserve the wildlife. There’s plenty of room for four-wheeling, trail riding and the like—if you can tear yourself away from the pub, that is.

8. Sloane House, London, England — $276 Million

Photo: Courtesy of Society Group

It’s no easy feat to turn a historic 18th-century Georgian estate into a luxurious modern abode, but Formula One heiress Petra Ecclestone has managed to do exactly that with Sloane House. The British billionaire decided to keep the shell of the property, which is located in the tony neighbourhood of Chelsea, but rebuilt pretty much everything else in just shy of five years. One highlight is the new basement, which includes a pool, gym, spa, hammam and squash courts, along with a salon, a kid’s playhouse and a screening room. Valued in excess of $276 million, the revamped property is now one of London’s hottest off-market offerings.

7. Tarpon Island, Palm Beach, Florida — $290 Million

Photo: Todd Michael Glaser

Yes, it’s an island, but don’t expect some far-flung hideaway in the Caribbean here. Tarpon Island is situated in the Billionaire’s Row sector of Palm Beach, a stretch of land that’s a veritable who’s who of real estate moguls: Citadel CEO Ken Griffin, who set the record for most expensive home sold in the US when he dropped US$240 million on a New York City penthouse nearly three years back, owns property here. Tarpon may net a similarly sky-high asking—it already traded hands earlier this year, in fact, when developer Todd Michael Glaser snapped it up for $117 million. Glaser is now selling the man-made isle for $290 million with the promise of renovating and expanding the circa-1930s home there for the prospective buyer. If you’d rather have it as is, then he’s willing to part with it for just $172 million. The planned renovation would add 1672sqm of living space, a six-car garage and two pools. Stuck-in-the-past home aside, it’s a 2.2-acre parcel altogether—a sizable piece of land for Palm Beach—with a lighted tennis court. And even though it’s not exactly the most private of islands, it’s only accessible via a small bridge or by boat, so you’ll still feel away from it all.

6. Casa Encantada, Los Angeles, California — $310 Million

Simon Berlyn

The real estate world expects big things of Casa Encantada. The last two times the historic Bel Air estate changed hands—in 1979 and 2000, respectively—it set the record for highest residential sale in the nation. The third time hasn’t been the charm, though. The 3716sqm Georgian-style mansion, which was once owned by hotelier Conrad Hilton, has been on the market since October 2019 and still no bites. Originally built in 1937 by architect James Dolena, the sprawling 60-room abode sits on eight acres above the Bel Air Country Club and comes complete with manicured gardens, a tennis court and koi pond. Now owned by financier and philanthropist Gary Winnick, Casa Encantada is patiently waiting to make history again.

5. One Hyde Park Penthouse, London, England — $341 Million

C&C

London’s most expensive penthouse brings a whole new meaning to the word “exclusive.” The lavish 1672sqm apartment is being offered for sale as a whisper listing, meaning brokers only share details with prospective buyers. (Luckily, we’re in the know.) On top of that, the two-floor condo is located in the ultra-affluent neighbourhood of Knightsbridge, right by a Rolex boutique and McLaren dealership. The crowning glory of supertall One Hyde Park, Penthouse B is priced at approximately $341 million. Owned by London real estate developer Nick Candy, the fully furnished five-bedder is full to the brim with suitably glitzy features, such as a Swarovski crystal chandelier and a hidden Champagne room. It also sports wraparound terraces that deliver postcard-like views of London’s famous Hyde Park.

4. Royal Style Mansion, Caesarea, Israel — $345 Million

Photo: Igal Harari/Israel Sotheby’s International Realty

If you’ve ever visited a royal castle or mansion and subsequently wanted to buy one of your own, well, now’s your chance. This massive, 5864sqm home was inspired by Baroque and Rococo architecture, and it shows. The interiors showcase marble and onyx mosaics and 14-carat gold moldings, and from the moment you walk in you’re greeted by an enormous crystal chandelier, sets of marble columns and a sweeping staircase that leads to the upper levels. And if all of that’s not enough, there are not one but two fountains in the home featuring Roman-style sculptures. Residents have access to a private spa and fitness room, two pools (one indoor and one outdoor) and saunas. It’s located not in Versailles but Caesarea, a town in Israel on the Mediterranean coast. All in all the mansion an architectural look that may not be for everyone, but it’s nothing if not impressive.

3. Cedarbrook Drive, Los Angeles, California — $345 Million

Hilton & Hyland

The next entry on our list promises to be the largest property ever permitted in Los Angeles—once it’s complete. It’s still under construction at the moment. When the dust settles the compound will be a whopping 7246sqm, a number rivalled only by Nile Niami’s embattled the One, which went into receivership earlier this year. Cedarbrook Drive will have many of the same over-the-top amenities (though a nightclub isn’t on the list so far), including a bowling lane, gym, cigar lounge, wine cellar and tasting room and a 36-person movie theatre. For car collectors, there will be a five-car garage with two turntables for displaying prized marques. Since it’s mapped out as a compound, there will be a separate guest house for visiting friends and family. Obviously, this is California, so an outdoor pool with a lounge area is also included in the renderings. Those who want to buy early can get a deal on the place, as it’s only $127 million to snap up once the foundation is complete. If you’d rather wait until everything is finished, well, that’ll be $345 million, please.

2. 24 Middle Gap Road, Hong Kong, China — $672 Million

Photo: Courtesy of Executive Homes HK

This particular Hong Kong property is a regular on our Most Expensive Homes for Sale list. Built in the early ‘90s, the two-story home at 24 Middle Gap Road spans a relatively modest 576sqm. It offers four bedrooms, four full baths, one half bath and a circular swimming pool in the back. At first blush, it doesn’t seem worth the exorbitant price tag, but what you’re really buying into is location. This third of an acre is located in Hong Kong’s ritzy Peak neighbourhood. It’s one of the city’s most sought-after enclaves, with one home even hitting the $907 million mark back in 2015. Maybe location really is everything.

1. Villa Aurora, Rome, Italy — $735 Million

Associated Press

The most expensive home in the world is a real buy one get one: Snag a priceless painting, receive a fixer-upper free. That’s the story with Villa Aurora anyway, which is priced at an eye-popping $735 million not for its plethora of amenities or top-of-the-line appliances, but for its artworks. The approximately 2787sqm mansion is the site of the only Caravaggio ceiling fresco in existence—that alone is worth an estimated $480 million. The six-floor home contains numerous other valuable works, including rooms with frescoes by Guercino and a statue in the driveway that’s attributed to Michelangelo. The catch, of course, is that the 500-year-old villa is showing its age. The current owner, Princess Rita Boncompagni Ludovisi, spent years restoring the place, but millions still need to be spent on renovating the old home. Who knows, while you’re at it you may even discover another priceless painting hidden somewhere in the walls.

Subscribe to the Newsletter

Recommended for you

This $42 Million Estate Sits on the 11th Hole of the Pebble Beach Golf Links

The six-bedroom home on 17 Mile Drive offers stunning views of the putting green and the Pacific Ocean.

By Tori Latham

November 19, 2025

Piccolo in name, monumental in design: A new benchmark for Melbourne luxury

A new standard in residential design is quietly taking shape in Melbourne’s prized Studley Park precinct.

November 18, 2025

You may also like.

You may also like.

Mauve on Up

Brisbane boutique stay Miss Midgley’s offers a viscerally human experience—especially if you dig pink.

On a sun-bleached corner of Brisbane’s New Farm, where the scent of frangipani mingles with the clink of coffee cups, stands a building that has lived more lives than most people. Once a premier’s residence, an orphanage, a hospital and a private school, the 160-year-old stone structure now finds itself reborn as Miss Midgley’s—a boutique stay that teaches a masterclass in how to make heritage feel modern.

Designed and run by architect-mother-daughter duo Lisa and Isabella White, Miss Midgley’s captures the cultural confidence of a city in bloom. Nowhere is that new confidence more visible than along James Street—the leafy, slow-burn heart of the city’s fashion and dining scene—where Miss Midgley’s sits quietly at the edge, its shell-pink façade glowing in the subtropical light.

Built of Brisbane’s rare volcanic tuff, the building’s soft mauves and pinks are more than aesthetic; they are its identity. Locals still remember its 1950s incarnation as the Pink Flats, and the Whites have honoured that legacy with a contemporary blush-toned exterior, chosen to harmonise with the stone’s peachy undertones. Inside, those hues continue in dusty terracottas, russets and the faint shimmer of brass tapware. “Design can’t afford to be for the sake of fashion,” Isabella White has said. “It has to respond to what’s in front of you.”

That sentiment is tangible in every corner. Five apartments, each with their own idiosyncratic floor plan, occupy the building. Ceilings bloom with heritage plasterwork, 19th-century wallpaper fragments have been preserved in the kitchens, and tiny hand-painted notes left by the architects point out original quirks: a misaligned beam here, a hidden archway there. It’s a kind of adult treasure hunt for design lovers, where discovery feels personal and unforced.

Even the picket fence, a heritage requirement, has been reimagined in corten steel—a sly nod to regulation turned into sculpture. It’s this blend of reverence and rebellion that gives Miss Midgley’s its edge: heritage without starch, nostalgia without sentimentality.

True to Brisbane’s easy elegance, luxury here is measured not in marble or minibar but in proportion, privacy, and personality. Each apartment—from the Drawing Room and the Assembly Hall to the Principal’s Office—is a self-contained sanctuary with its own kitchen, large bathroom and outdoor space. The ground-floor units open onto leafy courtyards and welcome small dogs; upstairs, the larger suites spill onto verandahs shaded by jacarandas.

At the heart of the property lies a solar-heated pool hemmed with tropical greenery and fringed umbrellas—more mid-century Palm Springs than colonial Brisbane. Around it, guests share a petite laundry, a communal library and that rarest of urban luxuries: a car park per apartment. The atmosphere is quietly collegiate—a handful of travellers who might nod to each other on the stairs but otherwise inhabit their own creative bubbles.

The hotel’s namesake, Annie Midgley, lends the project both its name and its spirit. An ambidextrous artist and teacher, she famously instructed two students at once, writing with both hands simultaneously—a fitting metaphor for the dual vision the Whites bring to the building: one hand rooted in history, the other sketching toward the future. “Not famous, yet known,” goes the property’s understated tagline—and indeed, Miss Midgley’s has quietly become that most desirable of addresses: the one whispered about by people who know.

Sustainability isn’t an accessory here; it’s structural. The adaptive reuse of the heritage building is its boldest environmental act. Solar panels power the property; an electric heat pump warms the pool; recycled decking and tiles frame the courtyard. The metre-thick tuff walls regulate temperature naturally, and the amenities follow suit—refillable bath products, biodegradable pods, Seljak blankets spun from textile off-cuts, and compendiums wrapped in Australian-made kangaroo leather. It’s slow luxury in the truest sense.

In a world of carbon-copy hotels, Miss Midgley’s feels deeply human—a place where history isn’t curated behind glass but lives in the warmth of stone and the flicker of afternoon light. The lesson it offers is simple and resonant: that the most elegant modernity often comes not from reinvention, but from listening to what’s already there.

You may also like.

My Brisbane…Monique Kawecki

The Queensland capital is carving its own distinctive take on Australian culture. Here, a clued-up local aesthete takes us around town.

It’s almost a given that all globally minded creatives will, at some juncture in their careers, choose a path that leads directly to one of the planet’s vital cultural hubs—metropolises with the cosmopolitan thrum of New York, the lofty elegance of Paris, the futuristic edge of Tokyo.

True to form, Monique Kawecki’s work odyssey transported her to the buzz of London for over a decade, but the editor and creative consultant now admits to “finding a balance” in Brisbane, using the Queensland capital as a base for generating international content. Together with her husband, industrial designer Alexander Lotersztain, she’s proud to call the fast-blooming city her home.

Driven by curiosity, Monique joins the dots between creative communities and helps bring visionary projects to life through her studio Champ Creative, a space she runs with her twin sister in Tokyo. Her work as co-founder and editorial director of Ala Champ Magazine, a print-turned-digital-media platform rooted in design, architecture and creative culture, allies thinkers and makers who are shaping the future.

EAT

Central

Step underground and you’ll find more than just a Hong Kong-inspired eatery. This vibrant enclave in the CBD is the vision of chef Benny Lam and young restaurateur David Flynn, combining an avant-garde space—designed by up-and-coming J.AR Office—with inventive Asian-fusion plates and a curated Chinese and Australian wine list. Every detail, from the menu to the disco-era soundscape, combines for a memorable experience.

Gerards

A restaurant that has long held its place among Brisbane’s primo venues, and its makeover by J.AR Office has confirmed it is a mainstay in the city. Rich, rammed-earth textures and sleek steel set the stage for the Levantine-inflected fare, where Queensland produce meets Middle Eastern tradition—all served on textured Sally Kerkin tableware that casts the eclectic dishes in an even more visually pleasing light.

DRINK

+81 Aizome Bar

Inspired by the hidden cocktail bars in Tokyo’s Ginza district, an intimate, indigo-hued 10-seater designed by Alexander Lotersztain. The dimly lit space presents drinks served over hand-cut Japanese ice and expertly crafted “neo cocktails” courtesy of mixologist Tony Huang. Champ Creative curated and sourced the artisan-made tableware and glassware from Japan, making sure the experience is as authentic as possible.

Bar Miette

Overlooking the Brisbane River, Australian chef Andrew McConnell has enlisted executive chef Jason Barratt to direct two of his standout dining ventures—this venue and Supernormal—on the waterfront at 443 Queen Street. Both offer stellar dining—the milk bun with mortadella and smoked maple syrup is simple yet sublime—but this is the spot to visit for a glass of wine accompanied by water vistas.

ART & CULTURE

QAGOMA

Together, the Queensland Art Gallery (QA) and Gallery of Modern Art (GOMA) form Australia’s largest modern and contemporary art gallery. Roosting on Brisbane’s South Bank, the establishment showcases exemplary art from Australia, Asia and the Pacific, and, as such, has become a firm favourite among both locals and tourists. By day, world-class exhibitions such as Danish artist Olafur Eliasson’s Presence—beginning December 6th—take centre stage; after dark, expect illuminated theatrics as GOMA permanently projects an intense, multi-hued James Turrell artwork onto its facade.

SHOP

BrownHaus

The experience of entering the luxurious, travertine-clad space is as beautiful as the creations the jewellery studio constructs. The culmination of founder Drew Brown’s 25 years of refining his craft, fine jewels and elevated everyday pieces for both men and women captivate your gaze, each example formed with the utmost intention and care. Moreover, Brown is redefining traditional artisanship and service in a new, modern way, ensuring the flagship store is accessible and exciting in equal measure.

James Street Precinct

For shopping, dining or even just perfecting the time-honoured art of people-watching, James Street is a one-stop hub where fashion, cinema, design and dining converge in Fortitude Valley. Wandering through the streets, discovering fresh, and established, ventures is a cinch. Restaurants sAme sAme and Biànca (from the team behind Agnes and the new Idle bakery) are hard to pass up; next door, be prepared to queue for a cone at Gelato Messina. A recent arrival to the zone is Heidi Middleton’s Artclub atelier, while Australian tailoring brand P. Johnson recently launched its new store, designed by the renowned Tamsin Johnson, across from The Calile hotel.

WELLNESS

The Bathhouse Albion

In Brisbane is home to multiple wellness centres in which one can work out or unwind, such as the five-floor, $80 million TotalFusion Platinum Newstead. This facility, designed by architectural practice Hogg & Lamb, presents a more serene, temple-like experience in the once-industrial Albion Fine Trades district, delivering a communal yet luxe bathhouse with spa, cold plunge, sauna, float, and steam room. With a separate area for hydration spruiking organic TeaGood loose-leaf teas, an hour session ensures a restorative reset.

DAY TRIP

Lady Elliot Island

Visiting one of the most pristine sections of the Great Barrier Reef in one day from Brisbane? Yes, it is indeed possible—and in style, too. With an early start from Redcliffe, around 40 minutes’ drive from the city, take a 90-minute flight to the 45-hectare island and then indulge in a glass-bottom boat viewing, an island tour, and a guided snorkel where you will swoon over mesmerising coral and other-worldly marine life. Lunch is included.

You may also like.

Tropical Storm

Brisbane’s design-led renaissance is gathering momentum and redefining the city as a destination of distinction.

When it comes to the question of which Australian city can claim to be the country’s epicentre of cool, it’s always been a two-horse race between you-know-who. But challengers to the municipal hegemony do periodically raise their heads above the cultural parapet: Hobart has the world-class MONA in its corner; Perth flexes its white-sand beaches and direct flights to London; plucky Canberra enduringly punches above its weight, wielding a Pollock masterpiece or two at the National Gallery. Now, Brisbane— for decades ironically nicknamed “BrisVegas” as a jibe at its lack of places to see and be seen—is ready to assert itself as a serious contender to break the Sydney-Melbourne monopoly.

The Queensland capital is booming, buzzing and bougier than ever. In the past twelve months alone, Brisbane has seen the addition of $80 million ultra-luxe members’ wellness club TotalFusion Platinum, and earned a place on Condé Nast Traveller’s Hot List for hosting the second outpost of Andrew McConnell’s renowned restaurant Supernormal—both designed by Sydney-based multidisciplinary studio ACME. Since the latter’s opening, the upscale dining scene in the CBD—once steeped in starched white-tablecloth tradition—has come into its own with high-concept, slick and scene-y establishments you’ve likely already seen on Instagram.

Among them is Central, named Australia’s best-designed space at this year’s Interior Design Awards. The subterranean late-night dumpling-bar-meets-disco, designed by one-to-watch local firm J.AR Office, is bathed in bright white light and features a DJ booth built into the open, epicentral kitchen. A 10-minute walk along the river towards the Botanic Gardens reveals Golden Avenue, a buzzy collaboration between J.AR Office and Anyday, the Brisbane hospitality group behind some of the city’s most beloved restaurants of the last decade (Biànca, hôntô, sAme sAme, and Agnes). A skylit oasis where palm fronds cast slivers of shade over tiled tables laden with bowls of baba ganoush and clay pots of blistered prawns, the Middle Eastern-inspired eatery feels like Queensland’s answer to Morocco’s walled courtyard gardens.

That design-forward premises anchor much of the buzz around Brisbane’s new pulse points should come as no surprise. After all, this is an urban centre whose perception and personality were transformed in the 2010s by the brutalist breeze-block facades of the then-burgeoning James Street Precinct. Financed by local developers the Malouf family, and designed by Brisbane’s architecture power couple Adrian Spence and Ingrid Richards, the zone has become a desirable, nationally recognised address for flashy flagships and big-name boutiques (just ask Artclub’s Heidi Middleton and The New Trend’s Vanessa Spencer, who each unveiled plush piled-carpet stores along the strip in October).

But it wasn’t until the 2018 opening of The Calile Hotel that Brisbane truly shed its “big country town” image, staking its claim on the international stage. The Palm Springs-inflected urban resort—which, by now, surely needs no introduction—landed 12th in 2023’s inaugural World’s 50 Best Hotels ranking, ahead of Claridge’s and Raffles.

“That was really quite massive for the optics of what Brisbane has to offer the rest of Australia,” says Ty Simon, a born-and-bred Brisbanite and one of the four visionaries behind the Anyday group, along with his details-driven Milanese wife Bianca, executive chef Ben Williamson, and financial backer Frank Li. From that point on, the use of elite architects and designers became de rigueur across the enclave, weaving a sense of permanence into the local fabric. “We believe in what’s happening here,” says Marie-Louise Theile, creative director of the James Street Initiative and PR executive behind many of the city’s primo spots. “And we’re digging in.”

For in-demand Australian interior designer Tamsin Johnson, the mastermind behind some of James Street’s most carefully curated properties—including her husband Patrick Johnson’s P. Johnson Femme showroom, which opened in September—this momentum is “a wonderful thing”. Idle, Johnson’s August-launched first project with Anyday, is a prime example of what she calls a “contemporary sleekness” that feels intrinsic to the new mood taking hold in Brisbane. A modern-day answer to Milan’s 140-year-old gourmet emporium Peck, the site is a study in how mixed materials—glass, concrete, stainless steel and terrazzo—can create a sense of freshness with a 20th-century overtone.

It’s this dialogue between old and new, so intrinsic to Johnson’s work, that makes Brisbane such a compelling canvas for the Melbourne-born, Sydney-based creative. “I think Brisbane is striving hard for its own identity and voice in Australia, and it is clearly working,” she says. For Johnson, that evolution is also “a process of recognising what you have”, a nod to the strong bones the city has to work with and revisit. From the airy stilted Queenslanders to GOMA’s riverside glass pavilion and the subtropical modernism of Donovan Hill’s landmark C House, Brisbane’s design heritage is a quiet yet potent force, infused with what Johnson calls “the subtle memory of bucolic Australia”. Brisbane’s best contemporary architecture reflects what Richards and Spence described when designing The Calile as “a gentle brutalism”. It incorporates the style’s characteristic heaviness—concrete, rigid geometry and cavernous interiors—but, in response to the climate, does away with barriers between outside and in, and welcomes light, air and a feeling of weightlessness that creates spaces that feel open, relaxed and intimately connected to their surroundings.

Johnson will explore this language further in Anyday’s most ambitious venture yet: a four-level dining destination within the colonial-era Coal Board Building, just across from Golden Avenue. Its debut concept The French Exit—a wood-panelled brasserie with half-height curtains and a 2.00 am licence—is set to be unveiled by year’s end, ensuring the once-sleepy heart will beat well into the early hours.

Luring big names to lend the city their cool factor for one-off projects is one thing, but perhaps the most profound sign that Brisbane still bursts with promise is the fact that so many creative forces are choosing to stay, rather than take their talent elsewhere. “I never thought I’d still be in Brisbane,” laughs J.AR Office director Jared Webb, a local-for-life who started the firm in Fortitude Valley in 2022 after a decade spent working under Richards and Spence. “Trying to entice people to stay and see Brisbane as a city to live in, and to visit, is a big undertone of all our work on a much broader scale,” says Webb, whose designs rely heavily on steel, concrete and stone, both as a means to temper the tropical climate and evoke an aura of continuity he believes Brisbane’s built environment has lacked. (Once dubbed the demolition capital of Australia, the municipality lost more than 60 historic buildings during the ’70s and ’80s under former Queensland premier Joh Bjelke-Petersen, whose two-decade rule was recently revisited in a dramatised documentary available to stream on Stan).

Translating Brisbane’s current buzz into something lasting seems to weigh on the minds of many of the city’s creatives. Vince Alafaci, who forms one half of ACME with his partner Caroline Choker, shares this sentiment when reflecting on their design for Supernormal. “It’s about creating spaces that evolve with time, not ones that date,” he says. “We wanted every element to feel timeless—grounded, honest and enduring.” That pursuit of longevity is something Tamsin Johnson recognises, too: “It’s the people pushing for it that excite me the most. They’re committed,” she says, reflecting on the city’s creative ambition. “I think our designers, the most committed ones, want to leave landmarks and character, bucking against the trend of mundane, short-term and artless developments that all our capitals have experienced. And perhaps Brisbane is leading this mentality.”

You may also like.

Holiday Gift Guide

The supreme Christmas wish-list awaits—maximum impact guaranteed.

Consider this your definitive shortcut to Christmas morning triumph. From museum-grade jewellery to objects of quiet obsession, this is a wish-list calibrated for maximum impact and minimal guesswork. Each piece in this round-up earns its place not through novelty, but through craft, heritage and that elusive quality collectors recognise instantly: desire with staying power. There are icons reimagined (Piaget’s Andy Warhol watch, a masterclass in pop-era permanence), feats of mechanical bravado (Jacob & Co.’s globe-trotting tourbillon), and indulgences that turn ritual into theatre—whether that’s a Hibiki 21 poured just so, or a Rolls-Royce picnic staged like a state occasion. Fashion, design, fragrance and fine drinking are all represented, but united by a single premise: these are gifts that signal intention. The kind that linger on the mantelpiece, wrist or memory long after the wrapping paper is cleared. The stocking at robbreport.com.au, as ever, is generously—and ingeniously—stuffed.

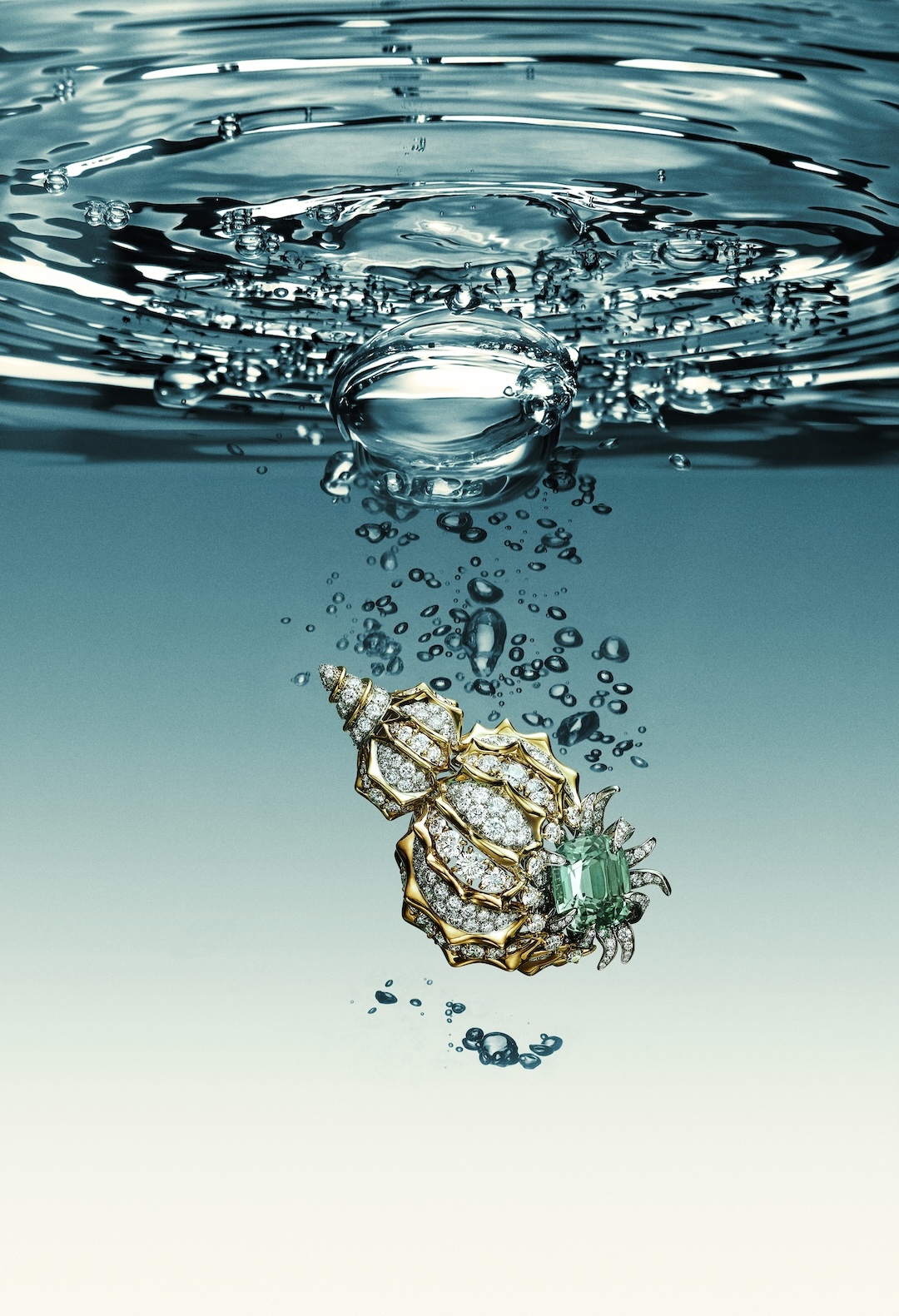

[main image, top] Tiffany & Co. Blue Book Collection Shell Green Tourmaline Brooch, POA; tiffany.com

Top Tip

Montegrappa limited edition 007 Special Issue fountain pen, $2,850, at The Independent Collective; theindependentcollective.com

Clear Winner

Alchemica ‘Transparent’ glass decanter, $1,000; artemest.com

Holding Court

Celine Halfmoon Soft Triomphe lambskin bag, $5,500; celine.com

Beauty and the Feast

Rolls-Royce picnic hamper, $59,676; rolls-roycemotorcars.com

Minutes of Fame

Piaget limited-edition Andy Warhol Watch Collage with 18-carat yellow gold caseback, $128,000; piaget.com

Fancy That

Graff High Jewellery fancy intense yellow oval, white oval and round diamond necklace, POA; kennedy.com.au

Momentos in Time

Christopher Boots Thalamos Keepsake trinket box, $859; christopherboots.com

Strapper’s Delight

Roger Vivier La Rose Vivier sandals in satin, $2,620; rogervivier.com

Sun Kings

Rimowa x Mykita Visor MR005 Aviator Sunshield, $940; rimowa.com

Take Your Best Shot

Hibiki 21 Year Old blended whisky, $1,399; kentstreetcellars.com.au

Making Perfect Scents

Creed Aventus, $559; creedperfume.com.au

Earth Hour

Jacob & Co. The World is Yours Dual Time Zone Tourbillon, $464,750; inspire@jacobandco.com.au

Glass Acts

Fferrone May coupe, $445 (set of two); spacefurniture.com

Fferrone May flute, $375 (set of two); spacefurniture.com

Worth the Wait

Masterson 2018 Shiraz. $1,000; available to order from the Peter Lehmann Cellar Door by calling (08) 8565 9555.

You may also like.

Radek Sali’s Wellspring of Youth

The wellness entrepreneur on why longevity isn’t a luxury—yet—and how the science of living well became Australia’s next great export.

Australian wellness pioneer Radek Sali is bringing his bold vision for longevity and human performance to the Gold Coast this weekend with Wanderlust Wellspring—a two-day summit running 25-26 October 2025 at the RACV Royal Pines Resort in Benowa. Sali, former CEO of Swisse and now co-founder of the event and investment firm Light Warrior, has long been at the intersection of wellness, business and conscious purpose.

Wellspring promises a packed agenda of global thought leaders in biohacking and longevity, including Sydney-born Harvard researcher David Sinclair, resilience pioneer Wim Hof, performance innovator Dave Asprey and muscle-health expert Gabrielle Lyon. From immersive workshops to diagnostics, tech showcases, and movement classes, Sali aims to make longevity less a niche pursuit for the elite and more an accessible cultural shift for all. Robb Report ANZ recently interviewed him for our Longevity feature. Here is an edited version of the conversation.

You’ve helped bring Wellspring to life at a moment when longevity seems to be dominating the cultural conversation. What drew you personally to this space?

I’ve always been passionate about wellness, and the language and refinement around how we achieve it are improving every day. Twenty years ago, when I was CEO of Swisse, a conference like this wouldn’t have had traction. Today, people’s interest in health and their thirst for knowledge continue to expand. What excites me is that wellness has moved into the realm of entertainment—people want to feel better, and that’s something I’ve always been happy to deliver.

There are wellness retreats, biohacking clinics, medical conferences everywhere. What makes Wellspring different?

Accessibility. A wellness retreat can be exclusive, but Wellspring democratises the experience. Tickets start at just $79, with options up to $1,800 for a platinum weekend pass. That means anyone can learn from the latest thought leaders. Too often in this space, barriers are put up that limit who can benefit from the science of biohacking. We want Wellspring to be for everyone.

You’re not just an organiser, but also an investor and participant in this field. How do you reconcile passion with commercial opportunity?

Any investment I make has to have purpose. Helping people optimise their health has driven me for two decades. It’s satisfying not just as an investor but as an operator—it builds wonderful culture within organisations and makes a real difference to people’s lives. That’s the natural fit for me, and something I want to keep refining.

What signals do you look for in longevity ventures to separate lasting impact from passing fads?

A lot of what we’re seeing now are actually old ideas resurfacing, supported by deeper scientific research. My father was one of the first in conventional medicine to talk about diet causing disease and meditation supporting mental health back in the 1970s. He was dismissed at first, but decades later, his work was validated. That experience taught me to look for evidence-based practices that endure. Today, we’re at a point where great scientists and doctors can headline events like Wellspring—that’s a huge cultural shift.

Longevity now carries a certain cultural cachet—its own insider language and status markers. How important is that to moving the field forward?

Health is our most precious asset, and people have always boasted about their routines—whether it’s going to the gym, doing a detox, or training for a marathon. What’s different now is that longevity practices are gaining mainstream recognition. I see it as something to be proud of, and I want to democratise access so everyone can ride the biohacking wave.

But some argue that for the ultra-wealthy, peak health has become a kind of luxury asset—like a private jet or a competitive edge.

That’s short-sighted. Yes, there are extremes, but most biohacking methods are accessible and inexpensive. Look at the blue zones—their lifestyle practices aren’t costly, yet they lead to long, healthy lives. That’s essential knowledge we should be sharing widely, and Wellspring is designed to do that in an engaging way.

Community is often cited as a key factor in healthspan. How does Wellspring foster that?

Community is at the heart of it. Just as Okinawa thrives on social connection, we want Wellspring to be a regular gathering place where people uplift each other. Ideally, it would become as busy as a Live Nation schedule—but for health and wellness.

Do you worry longevity could deepen class divides?

Class divides exist, and health isn’t immune. But in Australia, we’re fortunate—democracy and a strong equalisation process help maintain quality of life for most. Proactive healthcare, like supplementation and lifestyle changes, isn’t expensive. In fact, it’s cheaper than a daily coffee. That’s why we’re one of the top five longest-living nations. The opportunity is to keep improving by making proactive health accessible to everyone.

Some longevity ventures are described as “hedge-fund moonshots.” Others, like Wellspring, seem grounded in time-tested approaches. Where do you stand?

There’s value in both, but I’m more interested in sensible, sustainable practices. Things like exercise, meditation, and community-driven activities are proven to extend life and improve wellbeing. Technology can support this, but we can’t lose sight of the human elements—connection, balance, and purpose.

Finally, what role can Australia—and Wellspring—play in shaping the global longevity conversation?

The fact that we can put on an event like Wellspring, attract world-leading talent, and already have commitments for future years says a lot. Australia is far away, but that hasn’t stopped great scientists and thinkers from coming. We’ll be here every year, contributing to the global conversation and, hopefully, helping more people extend their healthspan.