Rolex May Be A Better Investment Than Gold

The last decade has been very good to the brand’s pre-owned timepieces.

Related articles

A Rolex isn’t just a coveted luxury watch. It can also make you money, apparently.

A new study carried out by online retailer Bob’s Watches shows the Swiss watchmaker’s timepieces can also be a good investment, according to Barron’s. An analysis of secondary market performance from the past decade showed that Rolexes regularly did better than more traditional investment options, like stocks, real estate and gold.

The study found that the average price of a used Rolex rose from just shy of approx. $7,000 to over $18,200 between 2011 and the end of last year. This trend only seems to be heating up, too, as the brand’s watches have appreciated in value as much since the start of the pandemic as they did during the five years prior to it. While the company analysed the performance of all Rolexes, there were two models in particular that stood out. The stainless-steel Submariner Ref. 16610 was easily the highest selling Rolex over the time period, while the Daytona is the model that has appreciated most, with an average pre-owned price of over $42,000.

Rolex Submariner 116610LN Courtesy of Bob’s Watches

It’s not a surprise to find out that Rolexes are in demand. After all, it is the world’s best-known watch brand. What is surprising, though, is how well the timepieces have performed when compared to other investments over the last decade. Bob’s Watches found that Rolexes easily outperformed both gold and real estate during that time after analysing market data from mactrotrends.net and the Federal Reserve Economic Data (FRED) database. Stocks and bonds performed just about as well as the watches, according to the Dow Jones Industrial Average, but timepieces appreciated by a much higher percentage.

“We were surprised by how much the values have appreciated,” says Bob’s Watches founder and CEO Paul Altieri told the financial publication. “We were hoping to come up in the top three, so we were happy that it was number one.”

We wouldn’t be surprised if Rolexes continue to prove to be a smart investment for years to come. Demand for the brand’s timepieces has soared since the start of the pandemic, in no small part because of supply chain issues. Rolex has already raised the price of some of its models, a change that will almost certainly be reflected on the secondary market soon, if it hasn’t already happened. In short, Rolex mania shows no signs of dying down anytime soon.

Subscribe to the Newsletter

Recommended for you

A New Chapter for Jaeger-LeCoultre’s ‘Reverso Stories’

A special Reverso exhibit arrives in Sydney this week.

By Josh Bozin

May 8, 2024

Watch of the Week: TAG Heuer Formula 1 | Kith

The legendary sports watch returns, but with an unexpected twist.

By Josh Bozin

May 2, 2024

You may also like.

By Josh Bozin

02/05/2024

30/04/2024

You may also like.

A New Chapter for Jaeger-LeCoultre’s ‘Reverso Stories’

A special Reverso exhibit arrives in Sydney this week.

In 2024, few watchfiends would be unfamiliar with Jaeger-LeCoultre and its enduring Reverso collection. Since 1931, the Reverso has been celebrated as one of the great dress watches of the 20th century.

In recent years, the watch has only gone from strength to strength—in 2023 alone, we received the new Reverso Tribute Chronograph, the impressive Duoface Tourbillon, and the slimmer Reverso Tribute Small Seconds—capturing the imagination of casual observers, collectors, and those looking to scale the horological ladder.

Thanks to exceptional branding experiences, such as ‘Reverso Stories’, a travelling experiential trunk show, it is also part of the cultural conversation. Jaeger-LeCoultre is again summoning its movable experience to Australia, this time in the heart of Sydney’s CBD. For a limited time, eager fans can glimpse the Reverso collection up close and personal via a multi-sensory exhibition tracing the history of this remarkable timepiece.

Presented in four chapters ( Icon, Style and design, Innovation, and Craftsmanship), the Reverso story will be told through the lens of Jaeger-LeCoultre’s expert watchmakers, who combine nine decades of craftsmanship, inventiveness, and design into one interactive experience.

As a bonus, guests will be privy to a large-scale art installation by Korean artist Yiyun Kang—commissioned by the Maison under its ‘Made of Makers’ programme—and the launch of three exceptional new Reverso timepieces, yet to be revealed. These watches will showcase skills such as enamelling, gold-leaf paillonage, and gem-setting, mastered by the manufacturer’s in-house Métiers Rares (Rare Handcrafts) atelier.

Completing the immersion into the spirit of Art Deco, guests will be able to enjoy a complementary refreshment post-experience at the pop-up Jaeger-LeCoultre 1931 Café.

—

‘Reverso Stories’ will be held in Sydney’s Martin Place from 10–19 May 2024. It will be open daily from 9 a.m. to 7 p.m. (and 5 p.m. on Sundays) and free to the public. Visitors are welcome to book online here or register upon arrival.

For more information, visit Jaeger-LeCoultre.

You may also like.

Watch of the Week: TAG Heuer Formula 1 | Kith

The legendary sports watch returns, but with an unexpected twist.

Over the last few years, watch pundits have predicted the return of the eccentric TAG Heuer Formula 1, in some shape or form. It was all but confirmed when TAG Heuer’s heritage director, Nicholas Biebuyck, teased a slew of vintage models on his Instagram account in the aftermath of last year’s Watches & Wonders 2023 in Geneva. And when speaking with Frédéric Arnault at last year’s trade fair, the former CEO asked me directly if the brand were to relaunch its legacy Formula 1 collection, loved by collectors globally, how should they go about it?

My answer to the baited entreaty definitely didn’t mention a collaboration with Ronnie Fieg of Kith, one of the world’s biggest streetwear fashion labels. Still, here we are: the TAG Heuer Formula 1 is officially back and as colourful as ever.

As the watch industry enters its hype era—in recent years, we’ve seen MoonSwatches, Scuba Fifty Fathoms, and John Mayer G-Shocks—the new Formula 1 x Kith collaboration might be the coolest yet.

Here’s the lowdown: overnight, TAG Heuer, together with Kith, took to socials to unveil a special, limited-edition collection of Formula 1 timepieces, inspired by the original collection from the 1980s. There are 10 new watches, all limited, with some designed on a stainless steel bracelet and some on an upgraded rubber strap; both options nod to the originals.

Seven are exclusive to Kith and its global stores (New York, Los Angeles, Miami, Hawaii, Tokyo, Toronto, and Paris, to be specific), and are made in an abundance of colours. Two are exclusive to TAG Heuer; and one is “shared” between TAG Heuer and Kith—this is a highlight of the collection, in our opinion. A faithful play on the original composite quartz watch from 1986, this model, limited to just 1,350 pieces globally, features the classic black bezel with red accents, a stainless steel bracelet, and that creamy eggshell dial, in all of its vintage-inspired glory. There’s no doubt that this particular model will present as pure nostalgia for those old enough to remember when the original TAG Heuer Formula 1 made its debut.

Of course, throughout the collection, Fieg’s design cues are punctuated: the “TAG” is replaced with “Kith,” forming a contentious new brand name for this specific release, as well as Kith’s slogan, “Just Us.”

Collectors and purists alike will appreciate the dedication to the original Formula 1 collection: features like the 35mm Arnite cases—sourced from the original 80s-era supplier—the form hour hand, a triangle with a dot inside at 12 o’clock, indices that alternate every quarter between shields and dots, and a contrasting minuterie, are all welcomed design specs that make this collaboration so great.

Every TAG Heuer Formula 1 | Kith timepiece will be presented in an eye-catching box that complements the fun and colour theme of Formula 1 but drives home the premium status of this collaboration. On that note, at $2,200 a piece, this isn’t exactly an approachable quartz watch but reflects the exclusive nature of Fieg’s Kith brand and the pieces he designs (largely limited-edition).

So, what do we think? It’s important not to understate the significance of the arrival of the TAG Heuer Formula 1 in 1986, in what would prove integral in setting up the brand for success throughout the 90’s—it was the very first watch collection to have “TAG Heuer” branding, after all—but also in helping to establish a new generation of watch consumer. Like Fieg, many millennial enthusiasts will recall their sentimental ties with the Formula 1, often their first timepiece in their horological journey.

This is as faithful of a reissue as we’ll get from TAG Heuer right now, and budding watch fans should be pleased with the result. To TAG Heuer’s credit, a great deal of research has gone into perfecting and replicating this iconic collection’s proportions, materials, and aesthetic for the modern-day consumer. Sure, it would have been nice to see a full lume dial, a distinguishing feature on some of the original pieces—why this wasn’t done is lost on me—and perhaps a more approachable price point, but there’s no doubt these will become an instant hit in the days to come.

—

The TAG Heuer Formula 1 | Kith collection will be available on Friday, May 3rd, exclusively in-store at select TAG Heuer and Kith locations in Miami, and available starting Monday, May 6th, at select TAG Heuer boutiques, all Kith shops, and online at Kith.com. To see the full collection, visit tagheuer.com

You may also like.

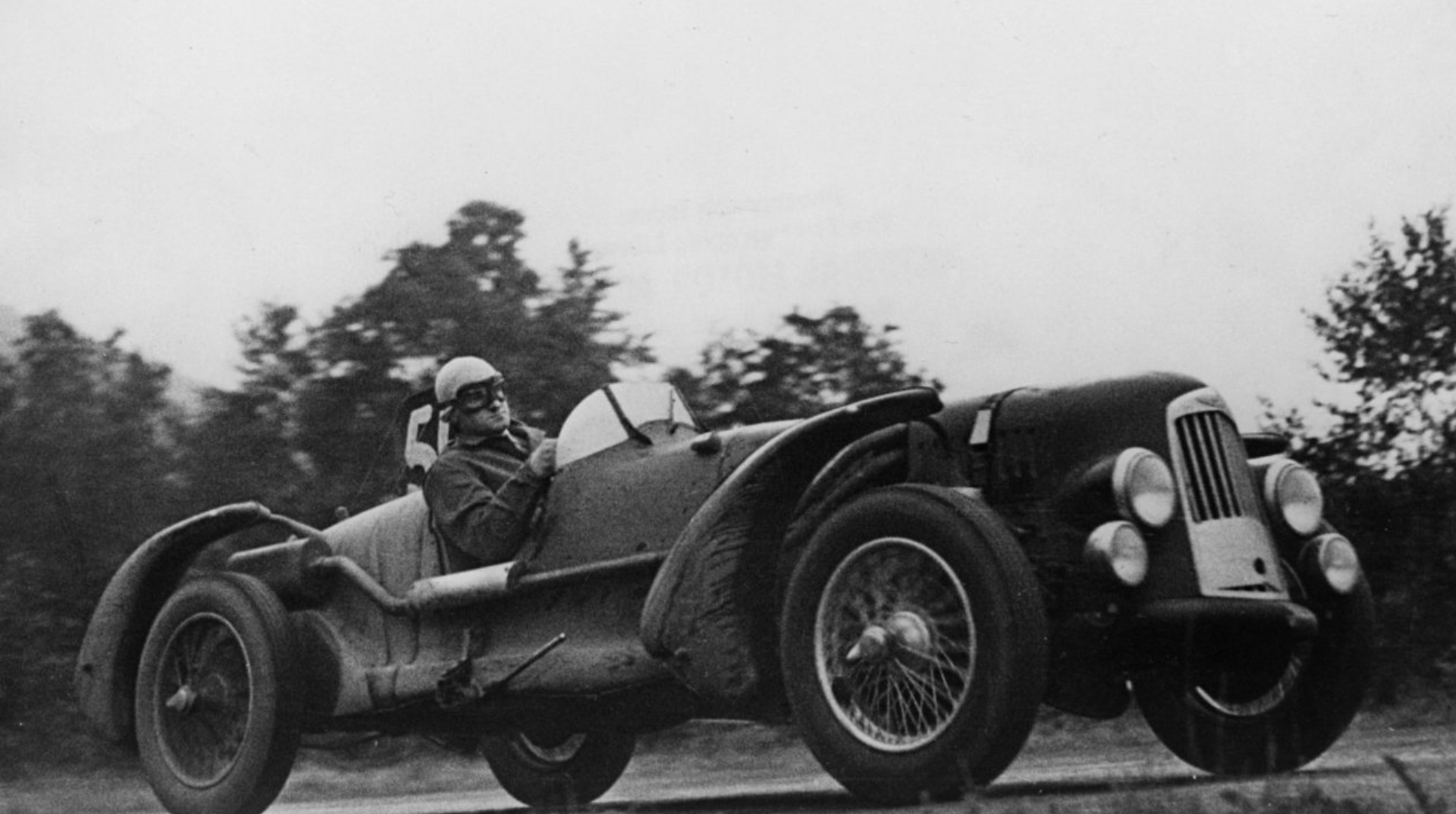

8 Fascinating Facts You Didn’t Know About Aston Martin

The British sports car company is most famous as the vehicle of choice for James Bond, but Aston Martin has an interesting history beyond 007.

Aston Martin will forever be associated with James Bond, ever since everyone’s favourite spy took delivery of his signature silver DB5 in the 1964 film Goldfinger. But there’s a lot more to the history of this famed British sports car brand beyond its association with the fictional British Secret Service agent.

Let’s dive into the long and colourful history of Aston Martin.

You may also like.

By Josh Bozin

02/05/2024

30/04/2024

What Venice’s New Tourist Tax Means for Your Next Trip

The Italian city will now charge visitors an entry fee during peak season.

Visiting the Floating City just got a bit more expensive.

Venice is officially the first metropolis in the world to start implementing a day-trip fee in an effort to help the Italian hot spot combat overtourism during peak season, The Associated Press reported. The new program, which went into effect, requires travellers to cough up roughly €5 (about $AUD8.50) per person before they can explore the city’s canals and historic sites. Back in January, Venice also announced that starting in June, it would cap the size of tourist groups to 25 people and prohibit loudspeakers in the city centre and the islands of Murano, Burano, and Torcello.

“We need to find a new balance between the tourists and residents,’ Simone Venturini, the city’s top tourism official, told AP News. “We need to safeguard the spaces of the residents, of course, and we need to discourage the arrival of day-trippers on some particular days.”

During this trial phase, the fee only applies to the 29 days deemed the busiest—between April 25 and July 14—and tickets will remain valid from 8:30 am to 4 pm. Visitors under 14 years of age will be allowed in free of charge in addition to guests with hotel reservations. However, the latter must apply online beforehand to request an exemption. Day-trippers can also pre-pay for tickets online via the city’s official tourism site or snap them up in person at the Santa Lucia train station.

“With courage and great humility, we are introducing this system because we want to give a future to Venice and leave this heritage of humanity to future generations,” Venice Mayor Luigi Brugnaro said in a statement on X (formerly known as Twitter) regarding the city’s much-talked-about entry fee.

Despite the mayor’s backing, it’s apparent that residents weren’t totally pleased with the program. The regulation led to protests and riots outside of the train station, The Independent reported. “We are against this measure because it will do nothing to stop overtourism,” resident Cristina Romieri told the outlet. “Moreover, it is such a complex regulation with so many exceptions that it will also be difficult to enforce it.”

While Venice is the first city to carry out the new day-tripper fee, several other European locales have introduced or raised tourist taxes to fend off large crowds and boost the local economy. Most recently, Barcelona increased its city-wide tourist tax. Similarly, you’ll have to pay an extra “climate crisis resilience” tax if you plan on visiting Greece that will fund the country’s disaster recovery projects.

You may also like.

By Josh Bozin

02/05/2024

30/04/2024

Omega Reveals a New Speedmaster Ahead of the Paris 2024 Olympics

Your first look at the new Speedmaster Chronoscope, designed in the colour theme of the Paris Olympics.

The starters are on the blocks, and with less than 100 days to go until the Paris 2024 Olympics, luxury Swiss watchmaker Omega was bound to release something spectacular to mark its bragging rights as the official timekeeper for the Summer Games. Enter the new 43mm Speedmaster Chronoscope, available in new colourways—gold, black, and white—in line with the colour theme of the Olympic Games in Paris this July.

So, what do we get in this nicely-wrapped, Olympics-inspired package? Technically, there are four new podium-worthy iterations of the iconic Speedmaster.

The new versions present handsomely in stainless steel or 18K Moonshine Gold—the brand’s proprietary yellow gold known for its enduring shine. The steel version has an anodised aluminium bezel and a stainless steel bracelet or vintage-inspired perforated leather strap. The Moonshine Gold iteration boasts a ceramic bezel; it will most likely appease Speedy collectors, particularly those with an affinity for Omega’s long-standing role as stewards of the Olympic Games.

Notably, each watch bears an attractive white opaline dial; the background to three dark grey timing scales in a 1940s “snail” design. Of course, this Speedmaster Chronoscope is special in its own right. For the most part, the overall look of the Speedmaster has remained true to its 1957 origins. This Speedmaster, however, adopts Omega’s Chronoscope design from 2021, including the storied tachymeter scale, along with a telemeter, and pulsometer scale—essentially, three different measurements on the wrist.

While the technical nature of this timepiece won’t interest some, others will revel in its theatrics. Turn over each timepiece, and instead of a transparent crystal caseback, there is a stamped medallion featuring a mirror-polished Paris 2024 logo, along with “Paris 2024” and the Olympic Rings—a subtle nod to this year’s games.

Powering this Olympiad offering—and ensuring the greatest level of accuracy—is the Co-Axial Master Chronometer Calibre 9908 and 9909, certified by METAS.

A Speedmaster to commemorate the Olympic Games was as sure a bet as Mondo Deplantis winning gold in the men’s pole vault—especially after Omega revealed its Olympic-edition Seamaster Diver 300m “Paris 2024” last year—but they delivered a great addition to the legacy collection, without gimmickry.

However, the all-gold Speedmaster is 85K at the top end of the scale, which is a lot of money for a watch of this stature. By comparison, the immaculate Speedmaster Moonshine gold with a sun-brushed green PVD “step” dial is 15K cheaper, albeit without the Chronoscope complications.

—

The Omega Speedmaster Chronoscope in stainless steel with a leather strap is priced at $15,725; stainless steel with steel bracelet at $16,275; 18k Moonshine Gold on leather strap $54,325; and 18k Moonshine Gold with matching gold bracelet $85,350, available at Omega boutiques now.

Discover the collection here

You may also like.

By Josh Bozin

02/05/2024

30/04/2024