Robb Read: When Money’s Not Enough

How scarcity informs luxury beyond cost.

Related articles

About a decade ago, with the world economy beginning to recover following the global financial meltdown, a budding art collector flew from New York to the Art Basel Miami Beach fair to buy a painting. “In my head I was the dream person, the up-and-coming collector that they want,” he recalls. “I was a decent-sized collector but not well-known. Not a banker who wants to flip. Someone who would buy as a long-term investment.”

An admirer of the hyper-realist artist Karel Funk, the collector, armed with a budget of approx. $583,000, inquired at the 303 Gallery booth about buying one of Funk’s paintings, then priced around $58,000, “but of course there was no price on display,” he says. The gallerist’s curt response: “There are some in the Whitney you can go and look at.” Recalling the dismissal today, he says, “I now know that most of the art is spoken for before the fair and that it’s a game that it’s open to the public to buy.”

The gatekeepers of the high-powered contemporary art scene are an elite unit whose mission, it seems, is to deter the general public. Of course, this zealous exclusivity is not confined to the world of art. Across many categories of luxury objects or experiences, access to the most hotly contested trophies is restricted to a select few, and the conditions of entry are about more than money. You cannot walk into a Rolex dealership, a New York power gallery or an Hermès boutique, ask for a Daytona, a Jeff Koons or a Birkin and expect to be allowed to buy it.

The shop where nothing is for sale is a well-established marketing strategy. “The notion of scarcity is a really fundamental principle in psychology,” says Kit Yarrow, PhD, a consumer psychologist and professor emerita at Golden Gate University, San Francisco. “We want what we can’t have. When we are denied, it feels like a challenge to overcome and we are more psychologically invested.” For the affluent, the desire provoked by denial is acute, says Yarrow, “because it’s boring to have anything you want. We all look for ways to bolster our egos, and for some, it is the acquisition of the unobtainable, the love of a person or a product, and in some ways products are easier.”

That rejection—and the challenge to reverse it—is part of what drives the desire. “Luxury goods resolve people’s insecurities about their place in society,” says Luca Solca, a luxury analyst at Sanford C. Bernstein. “I have, therefore I am. These things set us apart from the crowd and make us special, in our eyes, and our peers’ eyes.”

The aforementioned would-be Art Basel Miami Beach buyer, rather than giving up in the intervening years, says, “I have since spent millions of dollars on art, but I had a similar experience with Hauser & Wirth only last year. I went in and asked about Mark Bradford, and they laughed and said, ‘Before we’ll even consider you, send us a list of the artists you collect.’ I humoured them and sent it in, and they were like, ‘Okay, come in tomorrow.’”

From the gallerists’ perspective, this tactic is meant not as a brush-off but as a method of safeguarding their artists’ reputations. “If a collector walks in who we don’t know, yes, they need to introduce themselves [and tell us] what they have done and why,” says Marc Payot, a co-president of Hauser & Wirth. The Swiss multinational gallery, which represents Louise Bourgeois and Glenn Ligon, among other superstars, is not “a shop where you buy art like a commodity, first come first served”. Instead, the gallery is merely “the business card”. It aims to place art ultimately not with members of the public but with prestigious museums, because “the long-term success of an artist is directly dependent on the presence in institutions.” The gallery’s role, says Payot, is not so much to sell as to “put the artists we represent into the context of art history”.

In the face of this ambition, novice collectors often turn to art advisers. “We are a bridge between client and gallery,” says Suzanne Modica, cofounder of Modica Carr Art Advisory. Gallerists “are looking for an intellectual curiosity” in would-be buyers. “They want to know that the client is seeing the artist as more than just a bunch of dollar bills that are attached to the wall.”

Brett Gorvy, cofounder of the Lévy Gorvy gallery and a former international head of postwar and contemporary art at Christie’s, explains the pecking order

for art placement: “There is definitely a hierarchy—museums, private foundations, collectors with strong affiliations to museums, then prestigious collectors who lend to museums.” Only after this illustrious roll call will more quotidian collectors be considered.

There are tricks of the trade to get your foot in the door, according to one well-connected art adviser: “If you are extremely well-off you can become a trustee at a museum, which gives you cachet.” Sitting on a museum committee also enables connections to curators. At an art fair, “if you’re seen within proximity of curators, that can have a positive impact on your access.” But museum relationships are generally predicated on the expectation that, in addition to monetary donations, at least some of the works you acquire will eventually find their way to the museum in question, as a gift or bequest.

Many serious galleries—along with some sports-car marques—include language in sales agreements prohibiting buyers from flipping the objects at auction. Watch companies do not put such bans in writing but nevertheless keep careful track. Those who disobey in any of these categories risk being blacklisted. But new pieces by in-demand artists are often priced well below the sums they could fetch under the hammer, making the practice all too tempting for some. “When there is a big gap [in price] between the primary and secondary markets, we ask clients to give us a right of first refusal,” says Payot. “We have never sued, but access will be difficult in the future. The strongest protection is the relationship, but you can’t put a relationship in a contract.”

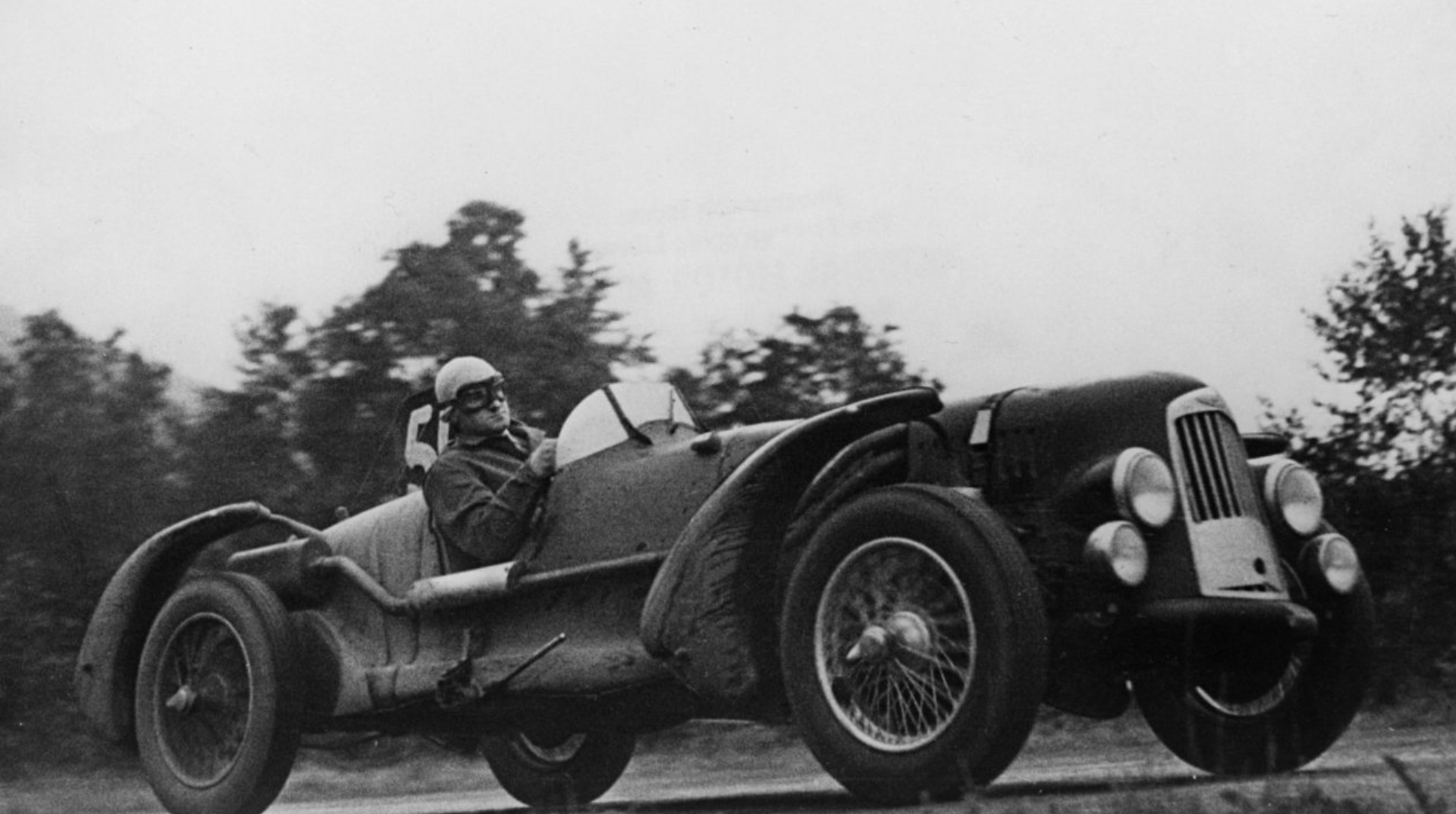

When it comes to art, there’s only so much an artist can produce, but even in the case of manufactured luxury goods, a tight supply translates to a ranking of buyers. Sports-car marques, including Ferrari, Lamborghini and Bugatti, reward their most loyal clients with first dibs on invite-only releases of special models. David Lee, a Ferrari collector who has appeared on Jay Leno’s Garage, says that access used to be “down to who you knew at the factory,” but a new tracking system tells Ferrari “exactly what cars you have, so they know whether you’re passionate or playing the game.

I have bought every car they released in the last few years, including ones that were not so popular. That data determines that I am a top client.”

Yet even favoured clients can have their privileges taken away. In 2017, Lee, who owns 30 Ferraris, was denied the chance to buy a LaFerrari Aperta, which had a run of only 210 models. His mistake, he believes, was discussing Ferrari’s secretive selection process with the Los Angeles Times. “Ferrari had told me I was in the running, but they had not yet decided,” he explains, so he told the newspaper he had not been offered one. The way Lee tells it, the resulting headline—basically, he owns a dozen Ferraris and has loads of cash, why can’t he buy the elusive $3.1-million LaFerrari Aperta?—didn’t go down well at Ferrari HQ.

“They read it over in Italy and thought I was using the media to pressure them to give me a car,” Lee says. “So for a few months we were on shaky ground. My relationship with Ferrari is very important, so it was really upsetting to me. They did not offer me a car.”

Quest for the Rolex Daytona: A Cautionary Tale

The hunt for a Rolex Daytona is the watch collector’s equivalent of the quest to find the Holy Grail. Despite their presence at major auctions, Daytonas remain near-impossible to find outside the secondary market. Though they’re relatively inexpensive by the standards of luxury watches—an entry-level steel-and-gold version retails for approx. $25,000—the Daytona’s mystique remains baffling.

I embarked on a mission to a Rolex boutique on Manhattan’s Fifth Avenue to see what the brush-off would be when I tried to buy the elusive model.

“I’m here to buy a Rolex,” I proclaimed to the doorman, who ushered me into a side room and into the care of a sales associate. I’ll call him James.

“I need to buy a birthday present for my husband, and I don’t know what to get,” I confided in James, who directed me toward a case containing Submariner watches. A steel-and-gold model would cost about $24,000, he said.

“I hear the Daytona is a good one,” I ventured. James looked a little sceptical. “We don’t have any in the store,” he said. “They’re very rare, and they all go to special clients.”

“Wow, do you have to go all the way to Switzerland to get one?”

“It’s even worse there,” he said. “You can’t just let anyone walk in and buy one. And that’s the right way to do things. Imagine if you saw someone wearing one and you asked where they got it and they said they walked in here and just picked one up. How would that make you feel if you’d been buying watches from us for years and had never got one?”

“Bad?”

“You need to put blood, sweat and tears into forming a relationship with the brand. You need to be a really loyal customer, and then we see it as a reward. So I can get you whatever you want, but it has to be realistic and not a Daytona.”

I left empty-handed but pleasingly reassured that money, liberally and strategically deployed, would do. LA marque’s signature red and has 1.1 million followers—says the relationship has since been repaired, and he is expecting delivery on five Ferraris this year.

The year before Lee’s dust-up, Preston Henn, an American flea-market mogul and two-time 24 Hours of Daytona winner, went so far as to sue Ferrari for damages, alleging the marque told his friends he was rejected because he was “not qualified” to buy a limited-release LaFerrari Spider. His qualifications were, according to court papers, the 18 Ferraris he had owned and the $1.46 million cheques he had mailed to Ferrari’s then-chairman, Sergio Marchionne (who had returned it). Henn accused the marque of “harming [his] reputation in the universe of Ferrari aficionados” but dropped the suit shortly before his death in April 2017.

Ferrari, which declined to comment about its specific allocation policies or criteria, is perhaps the best example of a company that successfully inspires in its devotees feelings not only of admiration but of identity. Lee, who is chairman of Hing Wa Lee, a watch-and-jewellery business outside Los Angeles, recognises the status anxiety in his Rolex customers: “For the client, it becomes an identity crisis. Where do they fit? How do they compare in this world? If they are able to get these very limited products, it shows they are considered to be at a certain level.”

Ferrari does not hide the fact that it deliberately keeps its production low to ensure demand is never satisfied. “The company was founded on one simple principle,” Marchionne told CNBC in 2015. “You only produce one car less than the demand for the vehicle.” To meet demand, he said, would “destroy the exclusivity of the brand”.

Yet Ferrari’s honesty about its artificially induced scarcity has not diminished the brand’s allure to its collectors, such as Barry Beck, cofounder of Bluemercury, the luxury beauty retailer. “With Ferrari, it has never been about money,” says Beck, who owns three Ferraris and collects Patek Philippe watches. “Many who have had the privilege to drive these cars or wear these timepieces have become devout, evangelical disciples and the brands’ best marketers.”

Similarly, even though the fabled waiting list for Hermès Birkin bags was exposed as a fiction by Michael Tonello in his 2008 memoir, Bringing Home the Birkin, the ardor of the brand’s fans has not dimmed. Tonello would ask for Birkin bags while shopping for scarves to flip on eBay and says the Hermès sales associates would tell him, “There’s a list, and there might even be a waiting list to get on the waiting list.”

Yet one day, after spending a large amount in an Hermès store, Tonello was offered a Birkin. “I realised that there was no waiting list,” Tonello tells Robb Report. He promptly switched to flipping Birkins. “They all have Birkin bags in the back. A Birkin is a reward for being a good customer. They don’t care who you are. You just have to spend money, and you have to know the formula.”

The same is true, he says, of watches: “Rolex won’t sell you a Daytona until you’ve spent a certain amount on other watches. Then you qualify for the private sales. It’s all a game.” Patek Philippe adds another layer, requiring clients to submit a formal application for special models. Beck recalls being told that a certain watch was “an application piece” (he initially thought this term had something to do with applied enamel). He included a Forbes profile to “grease the wheels” which, he says, ensured “near-immediate approval”.

Michael Hickcox, an avid watch collector and CEO of executive search company Expedition Partners, says that Patek Philippe allocates lesser models to new customers. “They want to hook you,” Hickcox explains. “People who try to go to the top straight away, they tend to be the ones who exit the hobby soon afterwards. They got what they want. They don’t spend 15 years saying, ‘I can’t wait until I have this one thing.’ Patek Philippe is going for the person who spends millions on watches.”

The flipping ban is an additional burden, particularly when sought-after watches from several prestigious makers can command twice their original prices. “I knew a dealer who sold a special watch [for a client] and that brand found out,” says Hickcox, adding that the dealer told him how the brand, in an apparent attempt to uncover the culprit, invited everyone who had bought the watch to a dinner. “The client had to call the dealer and ask to borrow it back. He did and wore it to the dinner, and the folks from the watch company never knew.”

Inside the inner circle, competitiveness does not diminish; it just becomes less purely financial and more about connections. At the dinners held by watch brands, executives toast their clients, who in turn make their cases for yet more coveted purchases. According to one watch-industry insider, the North American president of a renowned watch brand told the insider that at one such dinner he turned down a well-known entrepreneur’s plea to buy a special piece, even though the man had bought several other models in order to qualify. Only after the entrepreneur offered to speak at the graduation of the executive’s son did he relent.

Sometimes the dinners and events become as coveted, maybe even more so, than the items themselves. Lionel Geneste, a luxury-goods consultant, says the world of high jewellery is now dominated by an arms race of ever-ritzier events. “At the Paris shows Chanel did a dinner, Dior was at Versailles, Dolce & Gabbana now bring clients twice a year to Milan and Capri, Bulgari flies everyone to Rome and Van Cleef goes to the South of France,” he says. “It’s not that people are competing to be allowed to buy jewellery—they buy in order to be invited to these events.”

Jewellery produced by fashion houses is easy to acquire because it does not hold its value, says Fiona Druckenmiller, founder of FD Gallery, a Manhattan jewellery boutique. The same is true of contemporary pieces by Van Cleef & Arpels, Bulgari and Cartier, she says. Since they were acquired by large public companies, “you can get anything if you can afford it.”

Druckenmiller specialises in work by prestigious independent designers such as Hemmerle, Viren Bhagat and Joel Arthur Rosenthal, known as JAR, whose unique creations are much more difficult to obtain. To buy from these designers, she says, “it makes a difference if they like you.

This is a relationship in the true sense of the word, not just one based on money spent on collecting.”

With JAR, the only living jeweller to have had a solo show at New York’s Metropolitan Museum of Art (in 2013), “it’s hard to get in the door to begin with. You need an introduction,” Druckenmiller says. “And even then, if he feels like the woman is not a good ambassador for his pieces, he will say, ‘Nothing is available.’”

Independent watchmakers are similarly discriminating, selling only to collectors they deem worthy. “It’s somewhat a snob thing,” says Michael Hickcox, citing Philippe Dufour, Kari Voutilainen and Roger W. Smith, the latter of whom makes only 12 pieces a year. “You have to pay a £3,000 (AU$5,400) deposit to have the option to get on the waiting list. Several years later you get an e-mail saying, ‘Congratulations, you’re now in our production queue.’ You are not told what the price will be.”

Such treatment is bound to unnerve people unaccustomed to feeling powerless. A similar sensation has struck countless souls forced to face Manhattan’s most fastidious co-op boards, whose probing can be invasive and whose decision-making is shrouded in secrecy. Although the rise of Billionaire’s Row interview-free apartments has tempered some of the pickiness, for “old-school fancy buildings” a buyer has to have the right sort of money, says Lisa Chajet, a second-generation broker at New York’s Warburg Realty. Boards will want to know, “Did they make their money at Goldman or in casinos?” she says. Most favoured is “old money, a family trust that’s reputable and solid”. And if you come with a trail of paparazzi (Madonna) or a whiff of scandal (Richard Nixon), you’re probably better off bidding on a new apartment or a single-family townhouse. Once a co-op contract has been signed, Chajet’s approach is to get hold of the board list and call anyone who might have a connection with her buyer: “Maybe they both went to Yale, or they’re partners at law firms.” The most popular applicants? Doctors. “They don’t have the money that hedge-fund people have,” says Chajet, “but they have prestige.”

The preference for old money—and a WASPy family tree—is also alive and kicking in the notoriously exclusive world of private clubs in the Hamptons. While no one talks on the record for fear of being blackballed, insiders say the membership of several high-profile clubs in the enclave is largely comprised of elderly representatives of formerly illustrious Protestant families, who want to keep it that way. Membership is hereditary, according to those in the know; non-WASP new members are admitted rarely, and only in return for large donations to the upkeep of the club in question.

For many people, the effort required to obtain a supposedly exclusive object, be it an apartment or a wristwatch, is worth it, says Tonello, because it signifies success. “If you keep hearing about how hard something is to get, and how even famous people can’t get it, and then you get it, you feel like you are a master of the universe. I was in an elevator with a woman carrying a Birkin, and all these other women got in and saw her Birkin, and I could see them wonder who she was. She must be someone, a VIP? With guys, it’s the same with a watch. They send secret subliminal messages to others in the know. It says, I have arrived.”

Remember that art collector on a quest for a Karel Funk painting? The same gallery that rebuffed him at Art Basel Miami Beach finally offered him one several years later, for approx. $80,000. “I bought it,” he says. “Begrudgingly.”

This piece is from our new Design Issue – on sale now. Get your copy or subscribe here, or stay up to speed with the Robb Report weekly newsletter.

Subscribe to the Newsletter

Recommended for you

The Ultimate Guide to Pairing Wine With Spicy Food

What to drink when your favorite cuisine brings the heat.

Here’s What Goes Into Making Jay-Z’s $1,800 Champagne

We put Armand de Brignac Blanc de Noirs Assemblage No. 4 under the microsope.

By Mike Desimone And Jeff Jenssen

April 23, 2024

You may also like.

You may also like.

Watch of the Week: TAG Heuer Formula 1 | Kith

The legendary sports watch returns, but with an unexpected twist.

Over the last few years, watch pundits have predicted the return of the eccentric TAG Heuer Formula 1, in some shape or form. It was all but confirmed when TAG Heuer’s heritage director, Nicholas Biebuyck, teased a slew of vintage models on his Instagram account in the aftermath of last year’s Watches & Wonders 2023 in Geneva. And when speaking with Frédéric Arnault at last year’s trade fair, the former CEO asked me directly if the brand were to relaunch its legacy Formula 1 collection, loved by collectors globally, how should they go about it?

My answer to the baited entreaty definitely didn’t mention a collaboration with Ronnie Fieg of Kith, one of the world’s biggest streetwear fashion labels. Still, here we are: the TAG Heuer Formula 1 is officially back and as colourful as ever.

As the watch industry enters its hype era—in recent years, we’ve seen MoonSwatches, Scuba Fifty Fathoms, and John Mayer G-Shocks—the new Formula 1 x Kith collaboration might be the coolest yet.

Here’s the lowdown: overnight, TAG Heuer, together with Kith, took to socials to unveil a special, limited-edition collection of Formula 1 timepieces, inspired by the original collection from the 1980s. There are 10 new watches, all limited, with some designed on a stainless steel bracelet and some on an upgraded rubber strap; both options nod to the originals.

Seven are exclusive to Kith and its global stores (New York, Los Angeles, Miami, Hawaii, Tokyo, Toronto, and Paris, to be specific), and are made in an abundance of colours. Two are exclusive to TAG Heuer; and one is “shared” between TAG Heuer and Kith—this is a highlight of the collection, in our opinion. A faithful play on the original composite quartz watch from 1986, this model, limited to just 1,350 pieces globally, features the classic black bezel with red accents, a stainless steel bracelet, and that creamy eggshell dial, in all of its vintage-inspired glory. There’s no doubt that this particular model will present as pure nostalgia for those old enough to remember when the original TAG Heuer Formula 1 made its debut.

Of course, throughout the collection, Fieg’s design cues are punctuated: the “TAG” is replaced with “Kith,” forming a contentious new brand name for this specific release, as well as Kith’s slogan, “Just Us.”

Collectors and purists alike will appreciate the dedication to the original Formula 1 collection: features like the 35mm Arnite cases—sourced from the original 80s-era supplier—the form hour hand, a triangle with a dot inside at 12 o’clock, indices that alternate every quarter between shields and dots, and a contrasting minuterie, are all welcomed design specs that make this collaboration so great.

Every TAG Heuer Formula 1 | Kith timepiece will be presented in an eye-catching box that complements the fun and colour theme of Formula 1 but drives home the premium status of this collaboration. On that note, at $2,200 a piece, this isn’t exactly an approachable quartz watch but reflects the exclusive nature of Fieg’s Kith brand and the pieces he designs (largely limited-edition).

So, what do we think? It’s important not to understate the significance of the arrival of the TAG Heuer Formula 1 in 1986, in what would prove integral in setting up the brand for success throughout the 90’s—it was the very first watch collection to have “TAG Heuer” branding, after all—but also in helping to establish a new generation of watch consumer. Like Fieg, many millennial enthusiasts will recall their sentimental ties with the Formula 1, often their first timepiece in their horological journey.

This is as faithful of a reissue as we’ll get from TAG Heuer right now, and budding watch fans should be pleased with the result. To TAG Heuer’s credit, a great deal of research has gone into perfecting and replicating this iconic collection’s proportions, materials, and aesthetic for the modern-day consumer. Sure, it would have been nice to see a full lume dial, a distinguishing feature on some of the original pieces—why this wasn’t done is lost on me—and perhaps a more approachable price point, but there’s no doubt these will become an instant hit in the days to come.

—

The TAG Heuer Formula 1 | Kith collection will be available on Friday, May 3rd, exclusively in-store at select TAG Heuer and Kith locations in Miami, and available starting Monday, May 6th, at select TAG Heuer boutiques, all Kith shops, and online at Kith.com. To see the full collection, visit tagheuer.com

You may also like.

8 Fascinating Facts You Didn’t Know About Aston Martin

The British sports car company is most famous as the vehicle of choice for James Bond, but Aston Martin has an interesting history beyond 007.

Aston Martin will forever be associated with James Bond, ever since everyone’s favourite spy took delivery of his signature silver DB5 in the 1964 film Goldfinger. But there’s a lot more to the history of this famed British sports car brand beyond its association with the fictional British Secret Service agent.

Let’s dive into the long and colourful history of Aston Martin.

You may also like.

What Venice’s New Tourist Tax Means for Your Next Trip

The Italian city will now charge visitors an entry fee during peak season.

Visiting the Floating City just got a bit more expensive.

Venice is officially the first metropolis in the world to start implementing a day-trip fee in an effort to help the Italian hot spot combat overtourism during peak season, The Associated Press reported. The new program, which went into effect, requires travellers to cough up roughly €5 (about $AUD8.50) per person before they can explore the city’s canals and historic sites. Back in January, Venice also announced that starting in June, it would cap the size of tourist groups to 25 people and prohibit loudspeakers in the city centre and the islands of Murano, Burano, and Torcello.

“We need to find a new balance between the tourists and residents,’ Simone Venturini, the city’s top tourism official, told AP News. “We need to safeguard the spaces of the residents, of course, and we need to discourage the arrival of day-trippers on some particular days.”

During this trial phase, the fee only applies to the 29 days deemed the busiest—between April 25 and July 14—and tickets will remain valid from 8:30 am to 4 pm. Visitors under 14 years of age will be allowed in free of charge in addition to guests with hotel reservations. However, the latter must apply online beforehand to request an exemption. Day-trippers can also pre-pay for tickets online via the city’s official tourism site or snap them up in person at the Santa Lucia train station.

“With courage and great humility, we are introducing this system because we want to give a future to Venice and leave this heritage of humanity to future generations,” Venice Mayor Luigi Brugnaro said in a statement on X (formerly known as Twitter) regarding the city’s much-talked-about entry fee.

Despite the mayor’s backing, it’s apparent that residents weren’t totally pleased with the program. The regulation led to protests and riots outside of the train station, The Independent reported. “We are against this measure because it will do nothing to stop overtourism,” resident Cristina Romieri told the outlet. “Moreover, it is such a complex regulation with so many exceptions that it will also be difficult to enforce it.”

While Venice is the first city to carry out the new day-tripper fee, several other European locales have introduced or raised tourist taxes to fend off large crowds and boost the local economy. Most recently, Barcelona increased its city-wide tourist tax. Similarly, you’ll have to pay an extra “climate crisis resilience” tax if you plan on visiting Greece that will fund the country’s disaster recovery projects.

You may also like.

Omega Reveals a New Speedmaster Ahead of the Paris 2024 Olympics

Your first look at the new Speedmaster Chronoscope, designed in the colour theme of the Paris Olympics.

The starters are on the blocks, and with less than 100 days to go until the Paris 2024 Olympics, luxury Swiss watchmaker Omega was bound to release something spectacular to mark its bragging rights as the official timekeeper for the Summer Games. Enter the new 43mm Speedmaster Chronoscope, available in new colourways—gold, black, and white—in line with the colour theme of the Olympic Games in Paris this July.

So, what do we get in this nicely-wrapped, Olympics-inspired package? Technically, there are four new podium-worthy iterations of the iconic Speedmaster.

The new versions present handsomely in stainless steel or 18K Moonshine Gold—the brand’s proprietary yellow gold known for its enduring shine. The steel version has an anodised aluminium bezel and a stainless steel bracelet or vintage-inspired perforated leather strap. The Moonshine Gold iteration boasts a ceramic bezel; it will most likely appease Speedy collectors, particularly those with an affinity for Omega’s long-standing role as stewards of the Olympic Games.

Notably, each watch bears an attractive white opaline dial; the background to three dark grey timing scales in a 1940s “snail” design. Of course, this Speedmaster Chronoscope is special in its own right. For the most part, the overall look of the Speedmaster has remained true to its 1957 origins. This Speedmaster, however, adopts Omega’s Chronoscope design from 2021, including the storied tachymeter scale, along with a telemeter, and pulsometer scale—essentially, three different measurements on the wrist.

While the technical nature of this timepiece won’t interest some, others will revel in its theatrics. Turn over each timepiece, and instead of a transparent crystal caseback, there is a stamped medallion featuring a mirror-polished Paris 2024 logo, along with “Paris 2024” and the Olympic Rings—a subtle nod to this year’s games.

Powering this Olympiad offering—and ensuring the greatest level of accuracy—is the Co-Axial Master Chronometer Calibre 9908 and 9909, certified by METAS.

A Speedmaster to commemorate the Olympic Games was as sure a bet as Mondo Deplantis winning gold in the men’s pole vault—especially after Omega revealed its Olympic-edition Seamaster Diver 300m “Paris 2024” last year—but they delivered a great addition to the legacy collection, without gimmickry.

However, the all-gold Speedmaster is 85K at the top end of the scale, which is a lot of money for a watch of this stature. By comparison, the immaculate Speedmaster Moonshine gold with a sun-brushed green PVD “step” dial is 15K cheaper, albeit without the Chronoscope complications.

—

The Omega Speedmaster Chronoscope in stainless steel with a leather strap is priced at $15,725; stainless steel with steel bracelet at $16,275; 18k Moonshine Gold on leather strap $54,325; and 18k Moonshine Gold with matching gold bracelet $85,350, available at Omega boutiques now.

Discover the collection here

You may also like.

Here’s What Goes Into Making Jay-Z’s $1,800 Champagne

We put Armand de Brignac Blanc de Noirs Assemblage No. 4 under the microsope.

In our quest to locate the most exclusive and exciting wines for our readers, we usually ask the question, “How many bottles of this were made?” Often, we get a general response based on an annual average, although many Champagne houses simply respond, “We do not wish to communicate our quantities.” As far as we’re concerned, that’s pretty much like pleading the Fifth on the witness stand; yes, you’re not incriminating yourself, but anyone paying attention knows you’re probably guilty of something. In the case of some Champagne houses, that something is making a whole lot of bottles—millions of them—while creating an illusion of rarity.

We received the exact opposite reply regarding Armand de Brignac Blanc de Noirs Assemblage No. 4. Yasmin Allen, the company’s president and CEO, told us only 7,328 bottles would be released of this Pinot Noir offering. It’s good to know that with a sticker price of around $1,800, it’s highly limited, but it still makes one wonder what’s so exceptional about it.

Known by its nickname, Ace of Spades, for its distinctive and decorative metallic packaging, Armand de Brignac is owned by Louis Vuitton Moët Hennessy and Jay-Z and is produced by Champagne Cattier. Each bottle of Assemblage No. 4 is numbered; a small plate on the back reads “Assemblage Four, [X,XXX]/7,328, Disgorged: 20 April, 2023.” Prior to disgorgement, it spent seven years in the bottle on lees after primary fermentation mostly in stainless steel with a small amount in concrete. That’s the longest of the house’s Champagnes spent on the lees, but Allen says the winemaking team tasted along the way and would have disgorged earlier than planned if they’d felt the time was right.

Chef de cave, Alexandre Cattier, says the wine is sourced from some of the best Premier and Grand Cru Pinot Noir–producing villages in the Champagne region, including Chigny-les-Roses, Verzenay, Rilly-la-Montagne, Verzy, Ludes, Mailly-Champagne, and Ville-sur-Arce in the Aube département. This is considered a multi-vintage expression, using wine from a consecutive trio of vintages—2013, 2014, and 2015—to create an “intense and rich” blend. Seventy percent of the offering is from 2015 (hailed as one of the finest vintages in recent memory), with 15 percent each from the other two years.

This precisely crafted Champagne uses only the tête de cuvée juice, a highly selective extraction process. As Allen points out, “the winemakers solely take the first and freshest portion of the gentle cuvée grape press,” which assures that the finished wine will be the highest quality. Armand de Brignac used grapes from various sites and three different vintages so the final product would reflect the house signature style. This is the fourth release in a series that began with Assemblage No. 1. “Testing different levels of intensity of aromas with the balance of red and dark fruits has been a guiding principle between the Blanc de Noirs that followed,” Allen explains.

The CEO recommends allowing the Assemblage No. 4 to linger in your glass for a while, telling us, “Your palette will go on a journey, evolving from one incredible aroma to the next as the wine warms in your glass where it will open up to an extraordinary length.” We found it to have a gorgeous bouquet of raspberry and Mission fig with hints of river rock; as it opened, notes of toasted almond and just-baked brioche became noticeable. With striking acidity and a vein of minerality, it has luscious nectarine, passion fruit, candied orange peel, and red plum flavors with touches of beeswax and a whiff of baking spices on the enduring finish. We enjoyed our bottle with a roast chicken rubbed with butter and herbes de Provence and savored the final, extremely rare sip with a bit of Stilton. Unfortunately, the pairing possibilities are not infinite with this release; there are only 7,327 more ways to enjoy yours.