How Fashion Houses and Jewelers Are Giving Swiss Watchmakers a Run for Their Money

By snapping up some of Switzerland’s best manufacturers and watchmakers, brands including Chanel and Louis Vuitton are stunning even the most seasoned collectors.

Related articles

Perched on a couch last April in a private room inside Chanel’s sprawling space at Watches & Wonders, Frédéric Grangié and Arnaud Chastaingt appear positively serene. Outside, the world’s largest watch fair buzzes with energy as press, retailers, and VIP clients gather for a first-hand glimpse of the latest from a wide swath of brands, including the industry’s biggest hitters. Unlike at Paris Fashion Week, where Chanel is perpetually one of the hottest invites in town, here in Switzerland the maison’s iconic logo might actually be a disadvantage. The fashion house must vie for attention with horological heavyweights such as Patek Philippe and Rolex, which dominate the landscape and have catalogs of coveted models dating back hundreds of years. But Grangié, Chanel’s president of watches and fine jewelry, and Chastaingt, director of its Watchmaking Creation Studio, are unfazed. They insist that Chanel’s fresh perspective, combined with an incomparable fashion history and laser focus on savoir faire, actually gives the house an advantage in the world of haute horology.

“When we look at competition—and we are very respectful of them—some of the houses have been there for two centuries, some claim even more, but we are still in that phase where everything that we are creating is actually part of a living patrimony,” Grangié says. “We see the difference in what we are presenting because, of course. The biggest mistake that we could have made is to be a fashion company making watches, as opposed to a watchmaker whose manufacture and craftsmanship is at the service of creation.”

Chanel didn’t enter the watch domain until 1987, but in the short time since, it has become a trailblazer in terms of both innovation and creativity. Its J12 X-Ray, which debuted in 2020, was the first timepiece to feature a case and bracelet made from clear sapphire crystal; typically used to cover watch dials, the material is so hard it can only be machined with diamond-tipped tools. It’s also extremely expensive and difficult for companies to produce. Cutting-edge watch brands such as Hublot, Richard Mille, and Bell & Ross (in which Chanel has a minority stake) had produced the material for some of their special high-end cases, but the J12 marked the first time a sapphire-crystal bracelet had appeared on the market. “We had a competitor, a very important one, come to us here, and when they saw it they said, ‘We tried to do it and it was a nightmare,’” Grangié recalls, chuckling and adding, “I can confirm it is a nightmare.”

Nevertheless, Chanel followed up this year with a version in pink sapphire crystal, even more difficult thanks to the formidable challenge of maintaining colour consistency across the limited edition of 12. It’s just one example of how Chanel—alongside other fashion and jewelry houses from Bulgari and Van Cleef & Arpels to Hermès and Louis Vuitton—is elevating its watchmaking game, giving brands with centuries-old horological history a run for their money in the process.

Watches used to be an afterthought for luxury brands looking to expand their lifestyle portfolios. At jewelry houses, timepieces offered male clients a reason to treat themselves while buying baubles for their significant others, or they were seen as a mass-marketing tool, a means of enticing clients who might not be able to afford a million-dollar high-jewelry necklace or five-figure handbag.

But as social media began luring an entire new generation of watch enthusiasts—a trend that accelerated hugely during the pandemic—luxury houses began taking the category more seriously, seeing the long-term potential of upping the ante on both design and technical movements and increasing their investments accordingly. The result has been some of the most creative and challenging watchmaking happening anywhere in Switzerland—even if collectors have been slow to recognise it.

The race to compete for headline-grabbing horological feats has become fierce, and some of the creations defy belief. Take the ongoing tug-of-war between two houses with jewelry roots, Bulgari and Piaget, over laying claim to the most complicated timepieces in the thinnest possible cases.

Piaget took ultrathin engineering to a new level in 2018 when it created the Altiplano Ultimate Concept, the thinnest mechanical watch in the world at the time, measuring an incredible 2 mm thick; the previous record holder, the Master Ultra Thin Squelette from longtime traditional watchmaker Jaeger-LeCoultre, suddenly seemed hefty at 3.6 mm. Just four years later, Bulgari one-upped Piaget with its Octo Finissimo Ultra, which slimmed down to a mere 1.8 mm thick—a literal hair thicker than a quarter, despite packing 170 components and 50 hours of power reserve. It marked Bulgari’s eighth world record for thinness in the Octo Finissimo line. Some consider it a gimmick, but the race to reduce gave the company bragging rights over elite watchmakers in an industry where it’s hard to stand out.

“I remember very well when I said, ‘Why does a client today have to buy a Bulgari watch?’ ” says the company’s product creation executive director, Fabrizio Buonamassa Stigliani, recalling the early days when the Octo Finissimo was just an idea. “We are not linked with any path. We don’t follow the sport model. We are not in golf or in polo. We are not in aviation,” he notes. The label did have the Bulgari Bulgari timepiece, a successful branded fashion watch from the ’70s that was revived this year, but he says he began challenging the executive team to green-light more complicated pieces. No one had expected them to be able to create a movement at that level, and yet “we have this manufacture inside, and we are able to create the most ultrathin watches,” so why not use it to their advantage? “We started to use the story of [setting] the record to switch the lights on [in] the watches business,” Buonamassa Stigliani says.

The drive to bring something exciting and original to market is fueling a rush of new ideas, many from overlooked sources. Van Cleef & Arpels, for instance, infuses its 118 years of jewelry expertise into wildly complicated automaton wristwatches and clocks behind intricate facades. Unlike many traditional watchmaking houses, Van Cleef often leads with design and storytelling, with technical development serving as the means to turn its fanciful imaginings into reality.

The company has been creating complex automaton timepieces since 2006; its most recent example, Brise d’Été, boasts a field of grass and violets that appear to waft gently in the wind. A pair of butterflies crossing above indicate time on a retrograde time scale. “What’s interesting there for us—besides the idea of the poetry of time, which is why we call these watches Poetic Complications—is that when we started to work on these projects, we found out that they were technically very, very complex,” says Nicolas Bos, the former global president and CEO of Van Cleef & Arpels who is now the CEO of its parent company, Richemont. Van Cleef spent seven years developing table clocks that presented the same concepts on a much grander scale. The first example, Automate Fée Ondine, came to life in a whimsical scene set with a jewelled fairy resting atop a lily pad. “It required the expertise and inventiveness of around 20 workshops in France and Switzerland to devise this extraordinary objet,” says Bos.

Courtesy of Chanel

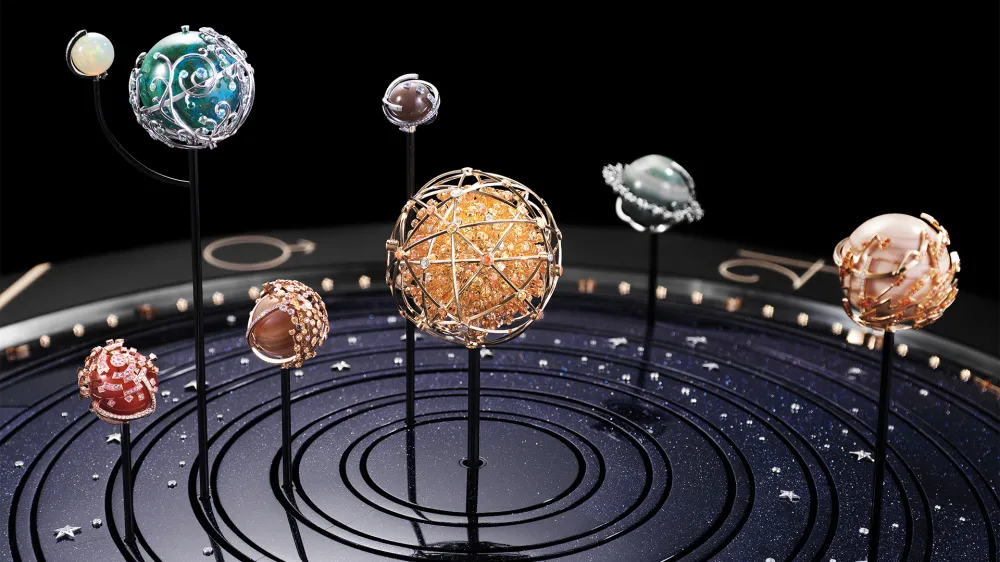

Masterminding creations at this level also requires in-house wizards, and many brands have strengthened their teams in order to construct even more advanced timepieces. When Van Cleef & Arpels director of research and development Rainer Bernard joined the company from Piaget in 2011, he was one of just four people hired to accelerate the watchmaking vision. Now, team headcount is at 20. Bernard says the fantastical ideas dreamed up by the house foster new mechanical achievements. “It actually gets us to places, technical places, where nobody has been,” he says. “This is why, for a while, we created between three to five patents every year.” These achievements are not for bragging rights on technicality but rather milestones leading to the creation of museum-worthy pieces. Take for instance the brand’s magnum-opus table clock, the Planétarium—a wonderland of rotating jeweled planets in a piece measuring nearly 20 inches high by 26 inches in diameter—where each sphere moves at its genuine speed of rotation set to a melody created with Michel Tirabosco, a Swiss musician and concert artist. It reportedly had a price tag of almost $10 million. “Since I’ve been here, with all the elements we put into place, we have more tools and more possibilities to really create and be crazy about our stories,” Bernard says. “So, we can do things we only dreamed of a couple of years ago.”

Courtesy of Louis Vuitton

The competition to wow collectors has become so stiff that, for some, hiring internally no longer suffices. Instead, luxury labels are snapping up revered Swiss manufactures whole or investing in smaller independent brands with elite expertise. Bulgari was an early pioneer of the practice, purchasing Gérald Genta and Daniel Roth in 2000. Buonamassa Stigliani joined the company just a few months later and says the acquisitions were key to Bulgari’s watchmaking growth. “It’s true that we found an amazing savoir faire, but it’s also true that we spent a huge, huge effort to achieve these results, because the idea was to have new movements,” he says. “The idea was to buy high-horology manufactures to find our path and to be the owner of our destiny.”

Having to source movements from outside manufactures poses several problems, including a lack of exclusivity and the potential for supply delays. But most importantly, bragging rights are typically reserved for companies that create their own. In-house production is a play for a rarefied, well-versed clientele. “You have to use a different language,” Buonamassa Stigliani says of appealing to serious connoisseurs. “You have to talk about the movement. You have to talk about technical constraints. The collector doesn’t talk with you if you’re talking just about shapes.”

Chanel has followed a similar path, making acquisitions that are both prestigious and technically adept. In 1993 it purchased G&F Châtelain, known for producing high-quality cases and movements, and in 2019 it acquired a minority interest in Swiss movement manufacturer Kenissi, an important supplier of sapphire-crystal glass to the industry. (Rolex is the main shareholder through its subsidiary, Tudor.) Chanel also owns stakes in Bell & Ross, Romain Gauthier—which helped Chanel develop its first complication, a jumping hour, in the Monsieur watch from 2016—and F. P. Journe. In August of this year, the Parisian house announced a surprise investment in avant-garde darling MB&F.

“Obviously, we are making our own watches, but we are also a supplier to many, many other houses, and that’s always been very Chanel,” says Grangié. “It’s the same thing with couture. The house owns many, many métiers—more than 35 at this point. We work for all the great names.

Of course, it wouldn’t be a luxury showdown without LVMH at the table. In 2011, the conglomerate purchased La Fabrique du Temps, a manufacture founded by watchmakers Enrico Barbasini and Michel Navas, who cut their teeth making ultra-high-end movements for Patek Philippe, among others. Based in Meyrin, Switzerland, the atelier is staffed with designers, engineers, and craftsmen who create timepieces for Louis Vuitton, Gérald Genta, and Daniel Roth. It has enabled Louis Vuitton to make some of its wildest and most inventive watches, such as the recent Tambour Opera Automata—a $871,813 automaton watch, nominated for a Grand Prix d’Horlogerie de Genève prize—that pays tribute to the Sichuan Opera’s Bian Lian tradition with a retrograde-minutes and jumping-hours function. Such over-the-top pieces aren’t for wallflowers, or even the typical watch enthusiast, but there’s no denying the sophistication of their calibers.

Courtesy of Hermès

Meanwhile, Jean Arnault, the 26-year-old son of LVMH honcho Bernard, has been hard at work overseeing the creation of beautifully crafted, if slightly more practical timepieces for Louis Vuitton, where he is the director of watches. Drew Coblitz, a Philadelphia-based alternative-asset-fund manager and seasoned watch collector, says he was interested in the Tambour Automatic when it came out, but talking to Arnault was what convinced him to purchase the timepiece. “You just get the impression that he’s supersmart and detail-oriented and thoughtful product-design-wise—the whole nine yards,” Coblitz says. “And the thing that he’s trying to do, branding-wise, is just really hard. It’s got to be one of the hardest things to do in watchmaking.”

He’s referring to the attempt to shift perception of Louis Vuitton from a fashion house to a maker of bona fide collector watches—and, with prices running from roughly $34,571 to $133,056, clients should expect the kind of top-notch watchmaking the house is delivering. While some of the high- horology pieces are for a flashier clientele, the Tambour and Escale lines are attracting collectors who, like Coblitz, care about finesse and nuance but want a more traditional look. “The amount of little-detail nerd stuff in the Tambour is killer,” Coblitz says. “And that’s before you turn it around, because the movement finishing is very nice.”

Creating this level of finishing on a series-production piece versus a limited edition such as the Tambour Opera Automata, though, is a stretch on resources, which means luxury houses are sizing up more manufactures to add to their rosters. Like Louis Vuitton, Hermès is not content to remain on the sidelines. This year, for example, it debuted the Arceau Duc Attelé, a feat of mechanical engineering that combines a triple-axis tourbillon with a minute repeater—the crème de la crème of complications—with hammers charmingly crafted as horse heads. The latest industry buzz circulating around longtime rivals Vuitton and Hermès, both famed predominantly for their premium leather goods and handbags, is their rumored competition to buy Vaucher, an elite Swiss manufacture known for its high-quality watch movements and components.

This summer, it was announced that niche watchmaker Parmigiani Fleurier and its network of subsidiary suppliers of watch parts, including Vaucher, are collectively up for sale by their parent company, the Sandoz Family Foundation. Hermès, which has owned a 25 percent stake in Vaucher since 2006, may seem like the logical suitor. But the house is now reportedly vying with LVMH for full ownership of the manufacture, which also supplies parts to other high-end watchmakers, including Chopard and Richard Mille; LVMH-owned TAG Heuer also outsources its higher-end movements through Vaucher. Hermès, Vuitton, and Parmigiani declined to comment for this article, but whoever gains control of the prized facility will have leverage over many of its competitors, and could even become their primary supplier.

As luxury brands continue to develop their watchmaking prowess by absorbing and investing in smaller specialised businesses, they pose a potentially significant challenge to the industry. Chanel, for its part, sees the business strategy as an opportunity to push boundaries. “Your competitors, who are also clients, will push you to develop things that you will not do for yourself,” says Grangié. “Then you become better at what you do, and you manage to have a model that will make your business sustainable over the long term, because you have those clients as well. To us, it’s a win-win proposition.” But for more-established watchmaking houses, the creativity inherent to fashion- and jewelry-first houses, backed by Switzerland’s finest horological specialists, could present a major threat.

Some are wise enough to move beyond their comfort zones: Just last month, Patek Philippe launched its first new collection in 25 years, aimed at a younger clientele. But Chanel, for one, is already barreling full steam ahead. “Next year, you will see something extraordinary that took a long time in the making,” hints Grangié. “We are creating an ecosystem to support our business and our future ambitions that relies on either the highest level of expertise or incredible names that we have become associated with first.” With historic houses seeking to attract fresh attention just as the fashion-forward upstarts hit their stride with never-before-seen innovations, we just might be on the brink of a remarkable new era in luxury watchmaking.

Subscribe to the Newsletter

Recommended for you

My Hong Kong

As the buzz around the East Asian cultural mecca amplifies, who better than two savvy, on-the-ground locals to curate an insider’s guide to the city’s essential experiences.

October 27, 2025

Stanley Tucci Fashioned a Chic Travel Wardrobe for N. Peal

The actor is doing his part to make trains and planes stylish again.

October 9, 2025

You may also like.

You may also like.

Radek Sali’s Wellspring of Youth

The wellness entrepreneur on why longevity isn’t a luxury—yet—and how the science of living well became Australia’s next great export.

Australian wellness pioneer Radek Sali is bringing his bold vision for longevity and human performance to the Gold Coast this weekend with Wanderlust Wellspring—a two-day summit running 25-26 October 2025 at the RACV Royal Pines Resort in Benowa. Sali, former CEO of Swisse and now co-founder of the event and investment firm Light Warrior, has long been at the intersection of wellness, business and conscious purpose.

Wellspring promises a packed agenda of global thought leaders in biohacking and longevity, including Sydney-born Harvard researcher David Sinclair, resilience pioneer Wim Hof, performance innovator Dave Asprey and muscle-health expert Gabrielle Lyon. From immersive workshops to diagnostics, tech showcases, and movement classes, Sali aims to make longevity less a niche pursuit for the elite and more an accessible cultural shift for all. Robb Report ANZ recently interviewed him for our Longevity feature. Here is an edited version of the conversation.

You’ve helped bring Wellspring to life at a moment when longevity seems to be dominating the cultural conversation. What drew you personally to this space?

I’ve always been passionate about wellness, and the language and refinement around how we achieve it are improving every day. Twenty years ago, when I was CEO of Swisse, a conference like this wouldn’t have had traction. Today, people’s interest in health and their thirst for knowledge continue to expand. What excites me is that wellness has moved into the realm of entertainment—people want to feel better, and that’s something I’ve always been happy to deliver.

There are wellness retreats, biohacking clinics, medical conferences everywhere. What makes Wellspring different?

Accessibility. A wellness retreat can be exclusive, but Wellspring democratises the experience. Tickets start at just $79, with options up to $1,800 for a platinum weekend pass. That means anyone can learn from the latest thought leaders. Too often in this space, barriers are put up that limit who can benefit from the science of biohacking. We want Wellspring to be for everyone.

You’re not just an organiser, but also an investor and participant in this field. How do you reconcile passion with commercial opportunity?

Any investment I make has to have purpose. Helping people optimise their health has driven me for two decades. It’s satisfying not just as an investor but as an operator—it builds wonderful culture within organisations and makes a real difference to people’s lives. That’s the natural fit for me, and something I want to keep refining.

What signals do you look for in longevity ventures to separate lasting impact from passing fads?

A lot of what we’re seeing now are actually old ideas resurfacing, supported by deeper scientific research. My father was one of the first in conventional medicine to talk about diet causing disease and meditation supporting mental health back in the 1970s. He was dismissed at first, but decades later, his work was validated. That experience taught me to look for evidence-based practices that endure. Today, we’re at a point where great scientists and doctors can headline events like Wellspring—that’s a huge cultural shift.

Longevity now carries a certain cultural cachet—its own insider language and status markers. How important is that to moving the field forward?

Health is our most precious asset, and people have always boasted about their routines—whether it’s going to the gym, doing a detox, or training for a marathon. What’s different now is that longevity practices are gaining mainstream recognition. I see it as something to be proud of, and I want to democratise access so everyone can ride the biohacking wave.

But some argue that for the ultra-wealthy, peak health has become a kind of luxury asset—like a private jet or a competitive edge.

That’s short-sighted. Yes, there are extremes, but most biohacking methods are accessible and inexpensive. Look at the blue zones—their lifestyle practices aren’t costly, yet they lead to long, healthy lives. That’s essential knowledge we should be sharing widely, and Wellspring is designed to do that in an engaging way.

Community is often cited as a key factor in healthspan. How does Wellspring foster that?

Community is at the heart of it. Just as Okinawa thrives on social connection, we want Wellspring to be a regular gathering place where people uplift each other. Ideally, it would become as busy as a Live Nation schedule—but for health and wellness.

Do you worry longevity could deepen class divides?

Class divides exist, and health isn’t immune. But in Australia, we’re fortunate—democracy and a strong equalisation process help maintain quality of life for most. Proactive healthcare, like supplementation and lifestyle changes, isn’t expensive. In fact, it’s cheaper than a daily coffee. That’s why we’re one of the top five longest-living nations. The opportunity is to keep improving by making proactive health accessible to everyone.

Some longevity ventures are described as “hedge-fund moonshots.” Others, like Wellspring, seem grounded in time-tested approaches. Where do you stand?

There’s value in both, but I’m more interested in sensible, sustainable practices. Things like exercise, meditation, and community-driven activities are proven to extend life and improve wellbeing. Technology can support this, but we can’t lose sight of the human elements—connection, balance, and purpose.

Finally, what role can Australia—and Wellspring—play in shaping the global longevity conversation?

The fact that we can put on an event like Wellspring, attract world-leading talent, and already have commitments for future years says a lot. Australia is far away, but that hasn’t stopped great scientists and thinkers from coming. We’ll be here every year, contributing to the global conversation and, hopefully, helping more people extend their healthspan.

You may also like.

‘Continuum’ Opens to Rave Applause at Sydney Dance Company

Rafael Bonachela’s latest curatorial triumph premiered last night at the Roslyn Packer Theatre, dazzling audiences with its emotional range and fearless physicality.

Sydney Dance Company opened its latest season with Continuum, a triple bill that reminds audiences why the ensemble remains Australia’s most compelling cultural export. Receiving a standing ovation at its premiere last night at the Roslyn Packer Theatre, the program unfolds as an elegant meditation on movement and metamorphosis—three distinct choreographic visions held together by Rafael Bonachela’s curatorial precision and instinct for contrast.

Stephen Page’s Unungkati Yantatja – one with the other breathes land, sea, and sky into motion; Tra Mi Dinh’s Somewhere between ten and fourteen lingers in the tender light between day and night; and Bonachela’s own world-premiere Spell delivers the evening’s visceral heartbeat. Together they trace the continuum of life itself—fluid, volatile, and impossible to pin down. Running through 1 November, the production affirms Bonachela’s vision of dance as “an ever-evolving conversation between artists, audiences, and the world around them.” Robb Report ANZ recently caught up with Bonachela.

Continuum is described as “a bold exploration of the ever-shifting cadence that binds us to the world.” How did this idea of constant transformation influence your choreographic choices in Continuum?

I’ve curated this evening as an invitation for audiences to experience dance as an ever-evolving conversation—between past and present, between the individual and the collective, and between diverse artistic voices. My intention with this program is to spark connection, curiosity, and reflection, offering works that challenge, move, and inspire while revealing the transformative power of the body in motion.

Each choreographer brings a distinct perspective, yet all share a commitment to exploring the body in motion as a vessel for transformation. Through contrasting aesthetics, cultural resonances, and shifts in time, these works reveal how dance exists on a continuum—where moments build upon one another, find new meanings in fresh contexts, and affirm the enduring power of the human form to express what words cannot.

You’ve created the world premiere Spell within Continuum, which explores “the limits of emotional and physical expression.” What did you aim to conjure emotionally and physically through Spell, and how does it dialogue with the other works in the triple bill?

The title Spell itself suggests a duality—it can be something magical, but also something we fall under without even realising. Emotionally, I want to evoke an atmosphere that is at once intimate and volatile, where vulnerability and power exist side by side. There’s a ritualistic quality to the work, as if the dancers are caught inside a force they cannot quite escape—and it’s that tension which drives the movement and fuels the piece.

Within Continuum, Spell emerges as an intense, visceral heart—both contrasting with and speaking to the other works. While it shares the evening’s theme of transformation, it explores it through a lens of emotional ignition and fearless physicality.

In crafting Continuum, how did you balance moments of intimacy and expansiveness—especially when layering live elements like music and immersive lighting—to evoke that ebb and flow of life’s narratives?

In Continuum, each choreographer works with complete artistic freedom, without any direction from me. That independence brings out authentic contrasts and unexpected connections between the works. It’s this variety that invites audiences to engage on their own terms, discovering personal meanings and emotional threads that are unique to each viewer.

This triple bill seems to offer a journey through time and place—from twilight’s fleeting beauty to elemental breath. How do you want audiences to experience—and perhaps rethink—the relationship between movement, nature, and storytelling?

I always want audiences to come with an open mind and allow the experience to be unprescribed free to discover their own meanings and narratives. Dance has the unique power to be felt as much as it is seen, to resonate physically and emotionally in ways words can’t. I hope audiences leave with a renewed sense of how deeply movement is connected to the natural world, and how it can tell stories without language. Like nature, this evening is always in motion—emerging, transforming, and fading—so that each work becomes a landscape the audience can journey through, sensing their own place in the continuum of life

Looking ahead, does Continuum carve out a new direction or personal milestone for your artistic trajectory? What might this signal for your future choreographic explorations?

Continuum feels like both a culmination and a starting point. It gathers threads from my past work, my fascination with transformation, my love of collaboration, my search for emotional truth and weaves them into something that opens new doors.

Creating and curating this triple bill has changed how I see works interacting—how contrasting voices can strengthen shared themes. It’s inspired me to explore even more fluid boundaries between ideas, styles, and disciplines.

If it signals anything for the future, it’s that I’m interested in going further into that space where dance is not just movement, but an ongoing conversation—between artists, between forms, and between audiences and the world around them.

Continuum runs through November 1 at the Roslyn Packer Theatre.

You may also like.

05/09/2025

By Brad Nash

18/08/2025

Inside the $30 Billion Obsession Among the Ultra-Wealthy : A Race to Live Longer

The pursuit of an extended life has become a new asset class for those who already own the jets, the vineyards, and the art collections. The only precious resource left to conquer, it seems, is time.

If you want to know what the latest obsession is these days among the ultra-wealthy, listen in at dinner.

Once it was crypto, then came AI and psychedelics, now it’s longevity all the time. The talk is of biomarkers, NAD+ levels, and methylation clocks, of senolytics and stem cells. Guests compare blood panels like wine lists, and the most important name to drop is no longer your banker or contact at Rolex but your longevity physician. For those just arriving at the conversation, the new science can sound like science fiction—but it’s fast becoming the lingua franca of money.

The field has its own vocabulary—epigenetic reprogramming, which aims to reset cellular clocks; cellular senescence clearance, the removal of “zombie” cells that clog our systems as we age; precision gene therapies, designed to personalise interventions at the level of DNA—that sounds equal parts Brave New World and Wall Street pitch deck. But make no mistake: this is no longer a niche pursuit. The sector is already worth an estimated $30 billion globally and projected to surpass $120 billion within the decade, having attracted billions in investment from the likes of Altos Labs, Juvenescence and Google-backed Calico. Tech titans and old-money families alike are staking claims on the possibility of an extra decade or two. It’s a space where venture funds court Nobel laureates, hedge funds bankroll gene-therapy moonshots, and even wellness festivals in Australia draw rock-star scientists to the stage.

The Poster Child and the Pitch

David Sinclair, the Sydney-born Harvard geneticist who has become something of a poster child for the field, is quick to underline the stakes. “We’re not just talking about lifespan, we’re talking about health span,” he tells Robb Report. “Extending the number of years people live well—without frailty, without disease—isn’t just a medical breakthrough. It’s a social and economic one.” Sinclair, whose research ranges from NAD boosters to epigenetic age-reversal therapies, has calculated that adding a single year of healthy life to the US population, for example, could be worth $38 trillion in economic benefit—fewer years of costly aged care, less burden on hospitals, more years of productivity and compounding returns. In other words, the dividends of health are financial as well as personal. “That’s why governments and investors are paying attention,” he says.

Sinclair has become a fixture on the global circuit, drawing crowds that rival TED or Davos. As Radek Sali, the Australian entrepreneur behind the new Wanderlust Wellspring longevity festival taking place on the Gold Coast this October, where Sinclair is the keynote speaker, puts it: “Wellness has moved into the realm of entertainment.” At Wellspring, platinum-tier guests pay up to nearly $2,000 for the privilege of hearing scientists and investors share the stage over a weekend like headliners at Coachella.

Investing in Time

And then there are the sideshows. Bryan Johnson, the tech mogul turned human guinea pig, makes headlines with his open-source, organ-by-organ data tracking—his infamous “penis readings” have become cocktail-party fodder. While many dismiss him as a parody of the field, his multimillion-dollar project Blueprint has nevertheless made longevity impossible to ignore in the mainstream.

For the uninitiated, the science of longevity today is no longer about vitamin salesmen or fringe dietary regimes. This is the new frontier—one where biology is not just observed but engineered, and where investors smell opportunity on par with space travel. It’s little wonder that Altos Labs has raised billions to chase cellular rejuvenation, or that Juvenescence has secured more than $400 million to fast-track therapies. What was once the realm of eccentric tinkerers now attracts sovereign wealth funds.

“This body takes me to meetings, earns me money—why not invest time and money into it?”

The appeal to the One Percent is obvious. Longevity is a natural extension of portfolio thinking: diversify your assets, hedge your risks, and above all, maximise return on investment. Except in this case, the returns are measured in years of health, energy and cognition. As Andrew Banks, a Sydney-based entrepreneur and early investor in Juvenescence, explains: “This body takes me to meetings, earns me money—why not invest time and money into it?” His Point Piper home teems with contraptions—a Reoxy breathing machine, hydrogen therapy, red-light sauna, and he spends a few hours a day on maintenance, as if his body were a private equity stake.

Banks, like others in his cohort, is baffled that more wealthy men haven’t followed suit. “Entrepreneurs pride themselves on divergent thinking,” he says. “They expand, dream and create businesses with it. But when it comes to their bodies, they’re convergent—unimaginative. The lack of curiosity is astonishing to me.”

Medicine 3.0 and the New Rituals

Steve Grace, a Sydney-based entrepreneur and the proprietor of exclusive private networking club The Pillars, which is opening a longevity program, thinks there is a reckoning coming for those who do not take matters into their own hands. “As someone who has run a few recruitment businesses,” he says, “I can tell you that if you’re a man or woman in your 50s and working as an employee, even in a really good position, it’s time to get worried about job security and being aged out of the workforce. You have to make yourself as vital as possible and become the best version of yourself, or you’re toast.”

What was once fringe has now become a cultural necessity for those who can afford anything, with science finally catching up to ambition. Sinclair’s lab at Harvard recently published a study on the reversibility of cellular ageing—restoring vision in blind mice and setting the stage for human trials in conditions like glaucoma. In Boston, his company Life Biosciences will begin treating patients with blindness in a Phase I trial using partial cellular reprogramming early next year. “This isn’t science fiction anymore,” Sinclair says. “We’re at the point where we can reprogram cells, turn back their biological clocks, and restore function.”

Meanwhile, practitioners like Dr. Adam Brown of the Longevity Institute in the Sydney suburb of Double Bay are reinventing diagnostics. His “assessment menu” has been compared—only half-jokingly—to a Michelin Guide for medical testing: full-body MRI scans, continuous glucose monitors, polygenic risk scores. “What we do is proactive, not reactive,” he says. “Correct deficiencies first, then optimise health. That’s how you get peak performance in the short term and resilience in the long term.” Brown frames longevity in terms that would resonate with any investor: “There’s a short-term ROI—fixing glucose or sleep issues so you perform better tomorrow. And there’s a long-term ROI—functioning in your 70s as you would in your 40s. That’s extending your career, your income potential and your independence.”

“Once upon a time, male vanity meant injectables, veneers and a tan. Today, it’s VO2 max scores and continuous glucose monitor readouts.”

Peter Attia, the Canadian-American physician and podcast host who has helped popularise the concept of “Medicine 3.0”, echoes this emphasis. Medicine 1.0, according to him, was about surviving infections. Medicine 2.0 was about treating chronic disease. Medicine 3.0 is about staying ahead of decline: measuring, monitoring and intervening early. “The goal is not just to avoid disease but to lengthen health span,” Attia has said.

For those already converted, longevity is less about lab science than daily rituals. Sydney-based Chief Brabon, who trains CEOs like athletes, says: “These men are like Formula One cars—you don’t wait until the tyres are bald before swapping them. You keep everything tuned, precise, optimised.”

That tuning now involves more gadgets than ever: hyperbaric oxygen chambers, cryotherapy, sauna/cold-plunge circuits, peptide stacks, nootropics. And yes, a glut of supplements, some with evidence, others little more than wishful thinking. Once upon a time, male vanity meant injectables, veneers and a tan. Today, it’s VO2 max scores and continuous glucose monitor readouts. “Health is the new flex,” as Steve Grace quipped, glancing at his wrist-worn biometric tracker.

The New Flex: Health as the Ultimate Luxury

Still, there is plenty of scepticism. Some therapies are unproven, others prohibitively expensive. And there is the unavoidable fact that many leading scientists, including Sinclair, have stakes in companies producing supplements and therapeutics, raising eyebrows about conflicts of interest. “The difference,” Sinclair insists, “is whether it’s backed by peer-reviewed science and measurable biomarkers. If it can’t be quantified, it’s marketing, not medicine.”

Then there are the contradictions. It promises democratisation while often priced like a private club. It champions science but thrives on hype. It seeks to extend health span but risks deepening class divides. “Only if we let it,” Sinclair says when asked if longevity risks becoming the preserve of the wealthy. “Like antibiotics or aspirin, these advances should become widely available and affordable once they scale.” Sali agrees, but from another angle: “Biohacking doesn’t have to be expensive,” he says. “The blue zones prove that—community, diet, movement, purpose. Those are free. Wellspring is about making that knowledge accessible.”

And yet, for all its shortcomings, the movement is here to stay. Investment continues to pour in. Technology—like senolytic drugs that clear aged cells or AI-driven platforms that predict individual disease risk years in advance—is moving from speculation to clinical trial. Scientists are being recast as influencers. And the wealthy, always in search of the next advantage, have found in longevity a pursuit as old as alchemy, yet dressed in the language of venture capital. The truth is that health has always been an asset. What’s new is that it’s now being traded, optimised and measured like one.

In the end, longevity is less about a moonshot than about curiosity. Banks, Sali, Sinclair, Attia are all, in their own way, betting on time. Perhaps the most radical idea is also the simplest: that the best-performing asset in any portfolio is the body itself. Unlike Bitcoin, it carries you to meetings. Unlike art, it cannot be stored in a vault. Unlike real estate, it is non-transferable.

The new calculus of longevity is the recognition that the ultimate luxury is not wealth or status, but a few more decades of clear thought, strong bones and good company—and the ability to make money off it. Everything else, as one investor put it, is just a rounding error.

You may also like.

How Sailing Shaped Loro Piana’s Most Iconic Designs

Pier Luigi Loro Piana grew his family textile business into a celebrated fashion house by following his passion for sports on land and at sea.

The Regatta Connection

The race village at Port de Saint-Tropez is awash with people in nautical navy and white, the de facto dress code for the Loro Piana Giraglia regatta. This is the second year the fashion house has lent its name to one of the Mediterranean’s most prestigious summer races. The course zooms from the French coast to Genoa, Italy, taking a sharp turn past Giraglia, a small island off Corsica’s northern tip. It’s the latest in a long line of marine events the brand has sponsored, dating back more than 20 years.

The link between sailing and the brand—and more consequentially the Loro Piana family—is exemplified by the man Robb Report is here to meet: Pier Luigi Loro Piana. An avuncular figure in his 70s with the physique of a man who has enjoyed life, Pier Luigi fell in love with sailing in his late teens, when a family friend took him for a cruise in a sloop.

“Using the wind to go faster or slower, driving the boat like it has an engine, it’s really fascinating,” he says. Inevitably, he started competing. “When you’re sailing, you’re always looking for other boats to go and fight with. It’s an instinct,” he says. And then, with considerable understatement, “I think it’s a nice hobby.”

A Life Under Sail

He currently owns two boats: My Song, which you can see on these pages, is a 25 m sailing yacht that competed in the Regatta. There’s also Masquenada, a comfortable 50 m explorer. It’s a commendable set-up befitting a man who shaped one of Europe’s most celebrated fashion houses.

A Family Business Turned Global Powerhouse

The textile and clothing company that bears his family’s name was launched by an ancestor, Pietro Loro Piana, in 1924. A few generations later, Pier Luigi and his brother, Sergio, would run it for four decades until LVMH acquired a majority stake for around $4 billion in 2013. Sergio passed away that year; his widow and Pier Luigi still own a share of the brand between them.

The brothers proved innovative custodians, moving the company upmarket with an insistence on ultra-fine materials and groundbreaking fabrications. And the connection with sports—specifically yachting, horseback riding, skiing and golf—is integral to how the brand positions itself. As Pier Luigi recalls, such associations often had self-serving origins.

“These are the sports my brother and myself were doing,” he says. “We were very committed in business in the 1970s, ’80s, ’90s, so we were like our customers: people that like to work hard but also play hard. And that meant sports.”

Innovation Born of Necessity

This affinity often led them to develop durable, yet elegant, materials and gear for their off-duty pursuits, eventually offering versions to their athletic clientele. “We engineered products with unusual properties, natural fibres like wool or cashmere with a membrane that makes it waterproof and windproof… For research and development, I was the first victim,” he says with a chuckle. Once, he wanted a ski jacket that was “warmer, lighter, softer and better” than nylon models, so he made a prototype to test on the slopes. It gave birth to the Loro Piana Storm System, launched in 1994. The line’s wind-resistant waterproof wool and cashmere has since been used by brands around the world. “I still have this jacket,” he says.

The same process happened on the water. A beloved reversible bomber, with knitted cashmere on one side and waterproof polyester on the other, was born from Pier Luigi’s need for a functional jacket to wear on his yacht. “It’s very light, doesn’t wrinkle, it’s warm, windproof,” he says. “It solves so many problems.”

He takes less credit for perhaps the brand’s most famous—and almost certainly most imitated—product, the white-soled suede Summer Walk loafers. “That was my brother,” he says. “When we were 20, 30 years old, we went sailing and there were only [Sperry] Top-Siders or Sebagos. But when the soles got worn, they got hard and slippery.”

The answer: a non-marking sole with grip—“like a tire you use in Formula 1 when it’s wet”—which Sergio got his bespoke shoemaker to sew to suede uppers. Eventually, they produced two versions: a loafer and the Open Walk, a model with a slightly higher top. “We discovered people were using them also for formal wear because they were so comfortable,” says Pier Luigi. “It’s really a successful story that started from product research.”

And if problem-solving can turn your family business into a giant of global style, clearly it pays to be a little selfish.

You may also like.

30/09/2025

The Supercar of Pool Tables

In a rare fusion of Italian design pedigree and artisanal craftsmanship, Pininfarina and Brandt have reframed the barroom game as aerodynamic high art.

In the rarefied realm where leisure meets design, the latest object of desire doesn’t purr down the autostrada—it commands the room from a single sculptural base. The Vici pool table, a collaboration between Italian automotive legend Pininfarina and Miami’s bespoke table-maker Brandt Design Studio, reimagines the game with the same aerodynamic poise and artisanal precision that have graced some of the world’s most beautiful vehicles.

Named for Julius Caesar’s immortal boast—“Veni, vidi, vici”—this limited-edition series transforms billiards from casual diversion into a declaration of style. Every curve is deliberate, from the ultra-thin playing surface clad in tournament-grade Simonis cloth to the seamless integration of Italian nubuck leather and precision-milled metals. The effect is more haute sculpture than barroom pastime—yet it meets exacting professional standards.

For the true connoisseur, the debut PF 95 Anniversario edition celebrates Pininfarina’s 95-year legacy in just 95 numbered pieces. Finished in dark-blue lacquer with rose-gold accents and a flash of red felt, each table is discreetly nameplated—a tangible claim to an heirloom in the making.

“It’s not just about how it plays—it’s about how it lives in a space,” says Dan Brandt, the master craftsman whose work has long graced the world’s most exclusive interiors. Whether anchoring a penthouse salon, a members’ lounge or the main deck of a superyacht, the Vici is designed to stir conversation before the first break.

For those accustomed to Pininfarina’s sleek automotive silhouettes, this is a chance to bring that same lineage of movement, form and Italian refinement into the home. Only now, the horsepower is measured not in engines—but in the geometry of a perfect shot.

From pool to midcentury to Ottoman, we’ve got all the table angles covered at Robb Report Australia & New Zealand —plus more home-worthy pieces.

You may also like.

01/09/2025

21/08/2025